Finance And Accounting – The university is registered as a higher education college under Articles 38 and 39 of the Private University Institutions Act 1996 with the Malaysian Government of the Ministry of Higher Education.

This app is a transformational experience for me. The mixture of theoretical and practical training was balanced and I gained valuable practical experience during clinical placement. The support of lecturers, lecturers and my classmates made the road reward. Now I am a registered nurse and I like every moment.

Finance And Accounting

The registered nurse diploma in the nursing program exceeded my expectations. A thorough course combining a wide range of clinical practice is well prepared for my role RN. The teacher is informed and supported and always encourages us to work towards perfection. I studied a kind of self-confidence and was well prepared for the challenges of nursing.

Diagram Of Financial Accounting Stock Photo

My education on the Registered Nurse Diploma in Nursing is the highest. The practical experience gained during clinical rotation is particularly valuable because it prepares me for real-world scenarios. Now, I work in a busy hospital environment and can provide the best care for patients.

Nursing Program Graduates Registered Nursing Diploma Continuously demonstrate outstanding clinical skills and professionalism. They are ready to meet the work requirements and integrate smoothly into our team. Their training clearly emphasizes patient and technical knowledge of care.

I am very proud to complete bioinformatics research at the university. The journey requirements and richness gave me a deep understanding of the intersection of computational biology, data analysis, and technology and life sciences. During my studies, I had the opportunity to work with informed professors and with talented friends, all of which improved my educational experience. This title gave me the skills and confidence to pursue a career in bioinformatics and I was excited about the opportunities ahead of us.

University research on BSC biotechnology is a transformational experience. Effective educators provide an effective teaching system in a pleasant environment. The complete facility allows for globally recognized research. I highly recommend colleges to receive top education.

Lowongan Kerja Bali

The consistent academic environment at the university not only deepens my knowledge in my field, but also respects basic skills such as critical thinking, collaboration and adaptability. All of these skills helped me build confidence in solving real world problems. All 8 years I spent on my title and PhD are very grateful.

The complete knowledge provided by the university and my research have enabled me to face market challenges and develop my career. Financial accounting is a specific department of accounting that involves recording, summarizing and reporting countless transactions generated by business operations over a period of time.

These transactions are summarized in preparation for financial statements – including balance sheets, statements of profits and losses, and statements of cash flows – record the company’s operating performance during the specified period.

Employment opportunities for financial accountants are located in the public and private sectors. The duties of a financial accountant may differ from the obligations of an accountant who prepares accounts, tax returns and, where appropriate, other corporate audits.

Financial Vs Managerial Accounting

Financial accounting uses a series of established principles. The accounting principles used depend on regulations and enterprise requirements in the company’s field. Companies and organizations often have accounting guidelines that list relevant accounting rules.

Public U.S. companies must conduct financial accounting in accordance with accepted accounting principles (GAAP). Their purpose is to provide consistent information to investors, creditors, regulators and tax agencies.

Statements used in financial accounting cover five main categories of financial data or financial accounts:

Income and expenses are collected and reported in statements of profits and losses, thereby determining net income at the bottom of the statement. Assets, liabilities and their own accounts are reported in the balance sheet, which uses financial accounting to report ownership of the company’s future economic interests.

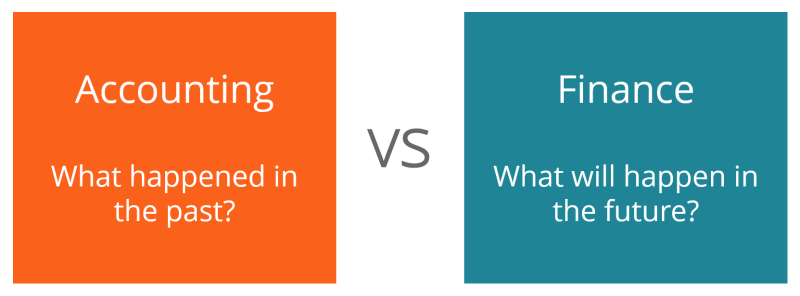

Finance Vs Accounting

The balance sheet states the financial status of the company on a specific date. It illustrates the above-mentioned assets, liabilities and equity of the company, and the financial statements of the company from one period to another. Financial accounting guidelines determine how a company records cash, asset value and performance debt.

The balance sheet is used by management, creditors and investors to assess the company’s liquidity and solvency. By analyzing financial ratios, financial accounting allows these parties to compare one balance sheet account with the other.

For example, the current ratio compares many current assets with current liabilities to determine how a company meets its short-term debt obligations.

A statement of profit and loss, also known as “profit and loss”, points to the company’s operating activities over a specific period of time.

Financial Accounting Vs Managerial Accounting

Statements of profits and losses are usually directed at net income, expenditure and net income for monthly, quarterly or annually, during the period. Financial accounting directives determine how a company displays revenue, records expenditures, and classifies the types of expenditures.

Profits and losses may be useful for management, but management accounting provides a better overview of production strategies and prices compared to financial accounting.

Financial accounting rules related to the income statement are more useful for investors who attempt to assess the profitability of a company that tries to assess the risk or consistency of an activity.

The cash flow statement points out how a company uses cash in a specific period. It is divided into three parts:

Financial Accounting Logo Royalty Free Vector Image

Financial accounting guidelines specify when transactions should be recorded, although the amount of cash in transactions is usually not low or has no flexibility.

Cash flow statements use management to better understand the purpose and acceptance of cash. It only extracts items that affect cash, which allows the brightest image of the currency to be used, which can be a little cloudy if the company uses additional accounting.

Unlike the balance sheet, the Equity Declaration announces how a company’s capital changes from one period to another, which is a picture of its own capital.

It shows how the surplus value of a company increases or decreases and why it changes. Provide detailed information about the following justice components:

Finance Vs. Accounting: Which Should You Study?

Nonprofit entities and government agencies use similar financial statements; however, their financial statements are more appropriate to their subject type and will vary based on the above statements.

There are two main types of financial accounting: time solution and cash approach. The main difference between them is the time when the transaction is recorded.

Financial accounting records transaction time solution is not related to cash use. Income is recorded when the account is obtained (when the account is sent) (when the account is actually arrived (when payment) (when payment). Expenses are recorded after the invoice is received, not when payment is paid. Accounting identifies the impact of transactions over a period of time.

For example, imagine a company that charges $1,000 for consulting will be completed next month. In Artul Artual’s accounting, $1,000 income is not allowed to be recognized as the work has not been completed and income has been obtained.

A Comparative Guide To Finance & Accounting Pricing Models

The transaction is recorded as cash and credit on the debit side to the account that is not income. When a company earns income next month, it removes illegal income loans and records actual income, thus removing cash debts.

Another example of a time resolution model is unpaid expenses. Imagine that the company received a $5,000 usage invoice in July.

Although the company did not pay accounts until August, incremental accounting requires the company to record a transaction in July, but for purposes of the field, respondents. The company records the credit of the account payable. When paying, the credit was deleted.

The cash accounting method is a lighter and less stringent way to prepare financial statements: transactions are recorded only when they are cash. Income and expenditure are recorded only after the transaction is completed through promotion funds.

Managerial Accounting Vs. Financial Accounting

In the example above, the consulting firm will record $1,000 from the consulting revenue when payment is received.

Although it won’t really work until next month, the cash method requires the income to be reported when cash is received. When the company is working next month, there is no record in the diary because the transaction will record the full quantity of the previous month.

In the second example, the cost of benefits will be recorded in August (the period when the invoice is paid). Despite the expenses associated with the services incurred in July, the financial accounting method requires recording the expenses when they are spent, not when they are incurred.

Financial accounting is determined by the five general principles of guidance