Financial Deepening Adalah – The country’s economic growth affects the impact of economic growth, especially in underdeveloped countries, the following rankings have good evidence.

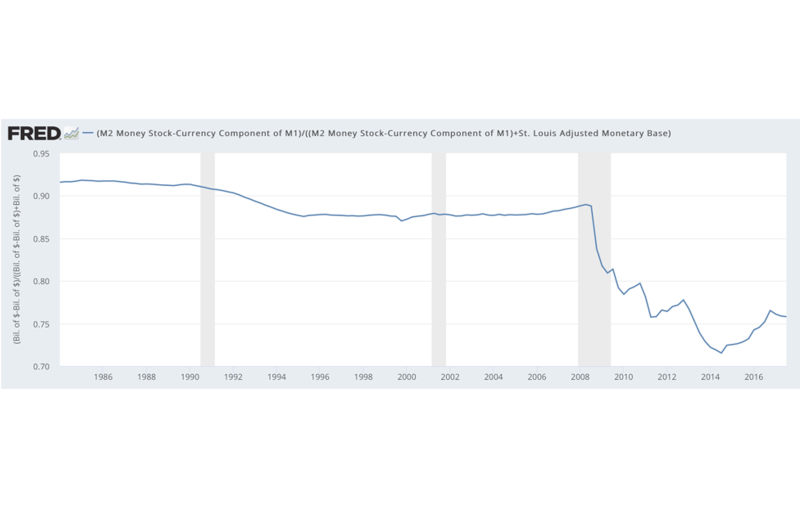

In chart 1, the “X” axis monitored the financial “solid” index developed by the IMF to measure the screening of the bank’s banking system, while the “Y” axis reflects the growth. When the Finance Department is developing, we can see, the trend of growth. However, the level of economic development is very high (at the end of the curve, note where the US stands) may have the opposite effect. In chart 2, the deepest financial monitoring against instability, we see the reflection of the chart 1: While the economic development is increasing from low levels, the fluctuations are overlooked, But the high level of high levels. In the economy, by the way, it is called the “linear” relationship.

Financial Deepening Adalah

Source: The author’s own calculation (2015A) uses the financial index developed by the IMF in Sahe and others. Note: Table A shows that the estimated impact of finance is deeper for each level of the curve index in Group A, keeping other fixed controls. The curve in Group B shows the estimated impact of the thoroughness of the fluctuations of the fluctuations of growth, keeping some other control measures. GDP growth is a remedy for growth as a five -year average deviation.

Build Effective Business Strategy For Financial Development Points Keys To Success And Financial Highlights Download Pdf

Is the impact of intensive banks in low -developed economies? In the study of 2, Agian at Al. “Transmission channel” – credit is determined. If everyone and companies have a lot of access to credit due to good financial system, long -term investment is on each class, because of low cost during the recession.

In addition, Carniro and Hanakovska argued in three Perper Paper that when the domestic financial market was developed less, people and the company faced more financial difficulties in the poor period and this did. Increase the impact of interest rates on domestic economic growth. Work. When the fluctuations are high, the production rate and consumption rate decrease, its impact will lead to low economic growth and the level of welfare for the community.

But in terms of economic development, a good thing may be: Recent studies show that exceeding a certain extent, economic development reduces the increase and stability (Arcond, Berks and Panza (2); Sahay et al. There are three arguments for why this is:

Thank you for choosing a part of Latin America and the Caribbean community! Your member is currently active. Latest blog posts and notifications related to blogs will be sent to your email. You can cancel the member at any time.