Health Insurance In United States – The latest filming of the general director of Unihealthcare, Brian Thompson, intensified the public review of private insurers and their role in the United States health system. It is often considered an “necessary evil”, these insurers have a remarkable impact on the health approach, reimbursement policies and professionals’ networks. For Medtech companies, understanding the dynamics of a health insurance consolidation market is essential for flowering in this complex environment.

The latest Report of the American Medical Association (AMA) offers a complete summary of the major health insurers in the United States and their market share over time:

Health Insurance In United States

While the graph shows sustainable percentages, it does not capture the complete vision of consolidation in the health insurance market. The health insurance markets are mostly local and the national market shares often mask higher levels of concentration at state and metropolitan levels. According to the 2024 edition of the American Medical Association in Health Insurance: a global study on US markets (PDF), 95% of metropolitan statistical areas are very concentrated, with BCBS insurers that lead to 83% of Saa. By joining how the 2018 Union between CVS Health and Aetna, for a value of $ 70 billion, further underlines this consolidation.

Health Insurance Policy Map: Indicators Of The Economic Impact On Each State — Penn Wharton Budget Model

The combined share of the market of the major insurers remains considerable, with the Uniethealth group, Elerance Health, CVS (Aetna), Green and HCSC (BCBS) that dominate the market. For Medtech companies, this concentration means that fewer decision makers has a greater impact on reimbursement policies and suppliers’ networks. Building relationships with these insurers is essential to access the market.

While some actors dominate the national market, their impact changes to the region. For example, Blue Cross Blue Shield (BCBS) organizations have a strong local presence in some countries. Medtech companies must adapt their strategies to face national and regional dynamics.

Consolidation often leads to more rigorous reimbursement policies and standardized criteria for the approval of the product. Medtech companies should position their products as solutions that correspond to the objectives of reducing the cost of these insurers and the objectives of the patient’s result.

With the least dominant insurance companies, Medtech companies should be strategically aimed at healthcare professionals associated with these key actors. Data -based platforms such as Alpha Sophia can help identify professionals and high value assistance sites based on billing trends, position, connections, volumes of procedures and more.

An In-depth History Of Health Insurance In The United States

Insurers ‘domain such as United Group, lists Health and CVS Health means that Medtech companies should underline how their products contribute to savings on the costs, efficiency and improvements of the patients’ results. The extraction of these benefits can accelerate approval in competitive markets.

Regional changes on the insurer’s impact require localized sales strategies. For example, a medtech company aimed at practitioners in California can prioritize California’s Shield Blue, while those of Michigan can focus on Mi Bcbs. The adaptation of the approach of local dynamics guarantees a more effective commitment.

Use analyzes to identify professionals who perform high volumes of relevant procedures and are associated with dominant insurers. By focusing efforts for these individuals, it is possible to maximize sales efficiency.

Explore partnerships with the main insurers to demonstrate how your products correspond to their objectives, how to reduce the readings of hospital readings or improve results in value -based assistance programs.

Health Care In America, By The Numbers

Combine requests and payment data (Sun Act) to obtain a complete view of high -value professionals and their belonging. Alpha Sophia integrates this knowledge to allow accurate strategies based on targets and data, providing a unique competitive advantage for smaller producers who navigate the complex dynamics and payers of payers.

Monitor changes in market dynamics to follow the behavior of interns, competitive standards and regional changes. The proactive adaptation guarantees that your strategy remains important.

The consolidation of health insurance markets presents unique challenges for Medtech companies, but also offers opportunities to perfect and optimize strategies. Understanding of the dynamics of these markets and using tools guided by data such as Alpha Sophia, Leader puts you can navigate in complexity, automotive adoption and grow in a competitive environment.

Diges billions of data lines and attributes such as CPT and HCPC billing, position, size of the practice and much more!

The State Of Health Insurance In America

We use similar monitoring cookies and technologies to improve your experience on our website. Clicking “Accept” and using our website accepts our use of similar cookie and tracing technologies. Look at our privacy policy for more details. Continuing on our website, you accept our use of cookies for statistical and personalization purposes. Know more

Mirror, Mirror 2024 is your opportunity to explore the impact of health and political choices of wellness in 10 countries, including the United States. Read the relationship here.

Cover of the state of health insurance in the results of the United States from the Commonwealth Fund 2024 Biennial Health Insurance Survey

Dr. Stela Kostova examines a patient in families together with Orange County in Tustin, California, February 21, 2023. Almost five of the implicit adults said they had avoided the health care necessary due to its costs. Photo: Paul Bersebach/MediaNews Group/Orange District Register via Getty Images

State Of Health Insurance Coverage In U.s.: 2024 Biennial Survey

About 26 million Americans, or 8 % of the American population, did not have health insurance in 2023.1 while the United States still remained universal coverage, the uninsured rate represents a change of sea compared to the years preceding their law on affordable prices (ACA), when two other people – 49 million people were provided when they graduated. In the individual market they loaded young women much higher than young people and rarely covered maternity assistance.

The Administration of the Congress and Biden -Harris has significantly strengthened the ACA with a temporary increase in premium subsidies for market plans during the pandemic and therefore extended them in 2022. In particular, the low -courtyard market plans were a source of coverage at affordable prices for people who lost Medicaid when the constant protection of the pandemic era has finished. Further subsidies have also allowed people in high -content employers plans to insert a more convenient coverage option.

Politics must do more to protect longer coverage profits and build these benefits to bring complete coverage to several people. Prolonged premium tax loans will expire at the end of 2025. If the congress does not extend the improved tax loans, market recorders will undergo an average increase in the $ 705 prize; 4 million more people are not expected. And many Americans with insurance are still loaded with medical debts, medical invoicing errors or coverage denial. 5

In the wake of a choice that can radically change the advantages of health care, we present the results of the investigation on the health insurance of the Commonwealth Fund to describe the state insurance coverage of the United States in 2024.6 We answer the following questions:

The End Of The Public Health Emergency Will Prompt Massive Transitions In Health Insurance Coverage: How State Insurance Regulators Can Prepare

For the study, SSRS interviewed a national representative sample of 8, 201 adults of age equal to or greater than 19 March between 18 March and 24 June 2024. This analysis is concentrated in 6, 480 interviewees aged between 19 and 64; The analysis of the population 65 and older, most of which to medicate will be published separately. Due to a new sampling method and the internet questionnaire presented in 2022, in addition to the changes to some main measures in 2024, we are unable to present data on the trends of the responses over the years. To find out more about our survey, including the sampling method revised, see “How we conducted this study”.

In 2024, most American adults had the coverage necessary to allow access to time and convenience. But there are clear areas for political action. Nine percent of adults were not insured at the time of the survey, 12 percent was insured, but said they had been without cover for a year and 23 % had a coverage all year round but was implicit. 7

For our analysis, the people provided throughout the year are considered implicit if their coverage does not provide accessible access to health care. This means that at least one of the following statements applies:

Since costs outside the pocket occur only if a person uses his insurance to obtain health care, we also consider the deduction when determining if someone is implicit. The discount is a financial protection indicator that offers a health plan, as well as the risk of causing costs before a person receives health care. However, we do not consider the risk of creating high costs due to other characteristics of the design of an insurance plan, such as caps, compensation or discovered services, since we do not ask for these characteristics in the study.

Report Discusses How ‘public Option’ May Put Pressure On Commercial Health Plans

Among the adults guaranteed by the working age in the United States that had costs or deductions such high compared to their income in 2024 that they had been actually provided, the vast majority was in the employers’ plans. About 14 percent had planned floors in the individual market or market countries and 17 percent was recorded in Medicaid or medicine.

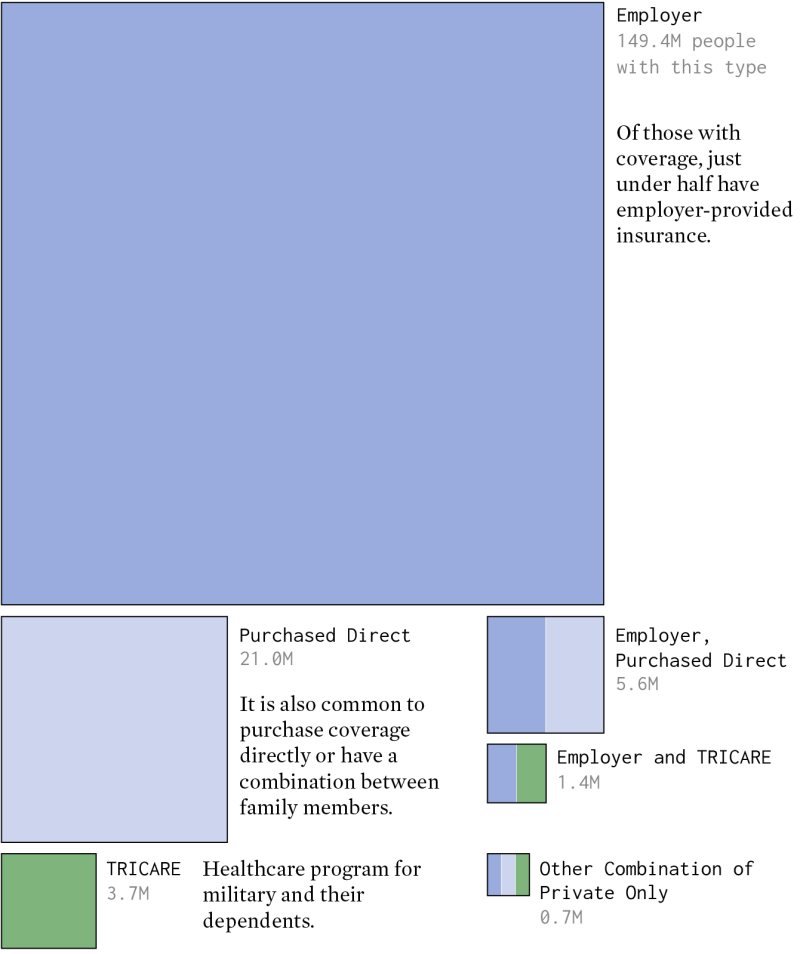

This implicit distribution of adults reflects the predominance of the coverage of employers in the US health insurance system and an increase in discounts and sharing costs in such plans over time. It also indicates it