Home Insurance Arkansas – With the help of our wise comparison tool, our experienced insurance agents and the most estimated housing -owned housing people we work for, can ensure that we get the best price and services without compromising quality.

Now, we will tell you all about the insurance of those who have housing in Arkansas: the basics, what is included and what it is not; We will explain the terminology and help you understand everything.

Home Insurance Arkansas

Arkansas is a family state, from hot springs to the capital of Little Rock to some of the most safe communities in the country, if you are looking for a place to create a perfect family environment to raise children, almost any city or suburb of Arkansas will do it.

Home Insurance Premiums Are Surging—and States Are Allowing It

In a population with little of 3 million, Arkansas is among the lovers in the middle of the list of the most popular United States states. However, it has a relatively high crime rate: 34.43 per thousand residents of the rate puts it in the Top 10, and only a few states have a higher rate: Tennessee, Alaska and New Mexico. Whether New York is safer than Arkansas, you created it or not.

It has a huge influence on the insurance premiums of the owner, so arkansawyers end up paying a higher appointment than the people of Maine, New Hampshire or Wyoming, for example.

This will not help the natural state to be susceptible to disasters. In fact, Arkansas has brought a list of the 10 major United States states that are susceptible to natural casualties with heavy rainfall, snow, ice, floods and even tornadoes.

As such, people in Arkansas are not easy to get cheap insurance quotes. But don’t worry: we are here to make sure to get the best possible treatment for the insurance of its arkansas -owned!

Best Renters Insurance In Arkansas: Top 5 Companies

Before providing additional information about premiums and how they are determined, let’s discuss some more things that may affect home insurance rates.

One of the most important terms you should know when buying Arkansas housing insurance policies is at risk.

The risk is an event that causes harm to its property. It can be an event of any kind, depending on the type of policy you get, all risk or so -called danger (more about it).

If something happened in his home, and the reason (the risk) was indicated in his policy, he was allowed to file a home insurance claim and receive compensation for his loss.

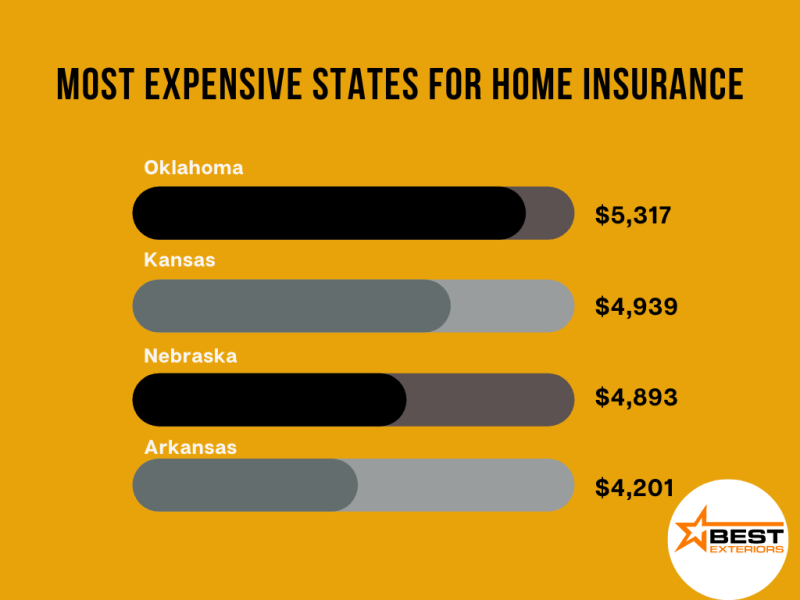

States With The Least & Most Expensive Homeowners Insurance

In the state of Arkansas, the dangers may include air damage, heavy rainfall, ice storm, fire, tornado, but also robbery, vandalism, robbery and similar crimes.

Unlike risks, deductibles are not covered by their home insurance, and this is the part to pay. If you file a claim, you will not receive compensation until you pay the deduction.

The general rule is: the higher the deduction, the lower the amount to be paid. You should discuss information about the deductibles in advance with your insurance company, so you know how much you should pay if it is.

Housing insurance premiums differ in state states: each has its own average annual premium, various risks, etc.

Insurance News From 2023

However, there are other factors that are not related to state laws that determine premiums. Let’s see and see what they are.

The Rakansas Housing Owners Insurance Rate depends on the insurance company you choose. Each of them has a set of insurance products with different price points and range options.

In the insurance geek, we work with some of the best housing insurance companies in Arkansas to provide products of the highest quality and competitive prices.

No matter what insurance provider you are going to, they want to verify your credit score. This is an important step in the process, as it gives them an idea of their overall financial history: how responsible for their payments, their time to repay their loans and similar.

See Where Home Insurance Policies Were Dropped In Your State

If you have a negative credit score, don’t get too much. While it can affect its insurance rates, this is not the important factor. However, don’t expect to get a good offer or the price you expect too.

Another thing your insurance provider will evaluate is the condition and value of your owner. It does not mean its market value, but the required price to pay any repair or rebuilding, or in other words, the replacement cost of your home.

The insurance company will verify the materials used to make your home, how many years you are and the general condition.

Since the largest part of the scope of its owners should be considered their home (potential repair, rebuilding, etc.), it is fairly that the insurance company confirms the accurate cost of replacement.

About M&p Insurance

Many people do not think about their previous claims when buying home insurance. Your insurance provider needs to verify if you have shown the claims before; It is in your best interest.

You will see, if you have a history of presenting claims and paid off, it tells them that your possession has experienced harm to risks, and that it is likely to happen again.

Don’t forget the deductibles we mentioned earlier. They play an important role in determining their insurance rate. As a general rule, you can get a lower insurance premium if your deductibles are high.

Fortunately, it can be eligible for many discounts when buying home insurance. For example, you can get a deduction if you pay in advance.

Mobile Home & Rv Insurance In Mo & The Midwest

You can combine those with -owned car insurance and life insurance insurance and claim your discount. We work to get the cheapest price for each of them, and if there is a discount available, we won’t lose it!

If you decide to get a lot of insurance policies, talk to our agents to see how much you can remove the initial price of your package.

Housing insurance policies come in two options. Depending on the scope options, there is a risk policy and a name risk policy.

Through a name -named hazard, their scope options are limited, as they only represent the risks indicated in their contract, therefore the name.

How Do I Know Who My Home Insurance Is With?

This is not the best choice for those who have housing in Arkansas due to the wide range of possible damage. However, it can be a great choice to cover any potential gap to existing arkansas housing.

If this is what you need, you can inform our agents all about your current policy so that we can get the required update.

Contrary to the designated policy, a policy of all risks covers all risks, except for those deliberately removed from the contract.

This is a better choice for arkansawyers, as it protects it against all possible damage, which is sufficient in the ground of opportunity.

Jay Freeman Insurance Agency Inc

Finding the cheapest appointment of home insurance is not always a piece of cake, and it is generally difficult to talk about prices and average appointments, as they depend on a so many personalized factors.

That’s why we created a smart comparison tool that could provide an offer within minutes.

You can consult and use a tool here. It takes a minute to complete the details about your home: Your Postal Code, Address and Status are all required for the insurance geek that coincides with the best possible price for your particular case.

Our specialized agents will use the connections we encourage the country’s most estimated insurance companies to find the cheapest household insurance policy adapted to their needs, as customer satisfaction and the experience of general positive are our main goal.

Average Cost Of Homeowners Insurance In 2025

When designing an insurance policy with -owned for their needs, our agents will do everything to get all the available discounts.

The good news is that there are many ways in which you can request discounts, from paying in advance to buy multiple insurance policies of the same carrier.

This is a great way to save some money, especially if you still don’t have other insurance policies in addition to insurance housing, such as car insurance or life insurance.

Since the insurance of the owners is more expensive in cities, many people choose for beautiful suburban areas of Arkansas, such as:

Best Arkansas Fair Plan Insurance Alternatives For You

Let us know your postal code today! Housing insurance quotes can vary by location, so don’t hesitate to contact us, we will do everything possible to get the best products and insurance rates of household insurance companies in Arkansas. Customer satisfaction is our number one priority!

Whether Arkansaer is born or that his postal code has changed recently, he should get insurance with the owners.

Having enough home insurance is worthless and knowing that it is protected from anything that happens in your home is a silence where you can’t put a price on.

Insurance with the housing -owned insurance not only covers it in the case of natural disasters, but you can also save if someone is injured or if they are accused of guilty of an accident in their ownership.

Average Homeowners Insurance Cost (october 2024)

To understand this better, check the following section where we provide information on what is included exactly the insurance policy of the owners.

These are the characteristics of the standard policy you can expect from a home insurance policy from most Arkansas insurance companies.

Housing range or the amount of housing is the amount dedicated to arranging the