Home Insurance Coverage – Whether you rent or hold your home, its property and content should be insured with insurance. For those who have houses, providing homeowners can cover the house and its content. If the house is rented, the owner will provide the property, while the tenant will be responsible for the material insurance.

Both homeowners and tenants need regular payments, usually as a monthly payment or an annual payment unit, and the policy must be in good condition for payment of debts. Both may require deductible payments for debts, if not mentioned in politics.

Home Insurance Coverage

House owners take the homeowners policy. The policy usually covers the cost of replacing personal and personal property.

Auto & Home Insurance Review: Compare Coverage Options For Your Needs

For example.

However, the insurance company will only cover the policy limit and it may be necessary to pay part of the cost – called deduction. In particular, homeowners cover the following types of Lisy insurance policies:

Examples of covered income may include fire, wind, hail, civil disorders, theft, broken glass and vandalism. However, it is important to check your policy, as it can provide basic or major coverage and you may need to buy an extended coverage for additional coverage.

You may need to pay the homeowners owners as part of your monthly mortgage payment. The creditor has some of your payment in the escrow account and can pay the insurance company on your behalf when the first is pending.

5 Common Things Not Covered By Home Insurance

The rent an insurance is intended for people who do not have properties, but want to protect their personal goods at home or on the property. It is important to note that, for tenants, it does not cover whether the owner of the property owner is damaged or destroyed the personal property of the Lisy tenant.

Lisy rental insurance policy can cover the replacement price of personal property, which means you get a new replacement item, regardless of the age of the original article. However, some policies cover the real value of the cash, ie the current value of the article. In other words, the value of the article is to reflect its age – the depreciation so called. The amount of compensation with the actual cash value can be much lower if the covered item is a few years old.

The cost of stolen or damaged property by storms, fires, smoking, vandalism and sudden damages are covered due to the defects of property from the rented insurance. Usually covered in personal baggage includes:

It can also be extended to the means of transport, stole items from the car, or covered a stolen bicycle while you were at work.

Home Insurance In Canada

If your rental unit is damaged or desolate by a covered event and when repaired, you must stay elsewhere, your life’s rent, including insurance food, can cover the cost of living. However, check the policy to make sure this coverage is included.

If a slip or fall is injured and you can find yourself in the guilt, if you request, including legal fees, the rent insurance policy can reach the policy limit.

The insurance coverage of the housing owner involves the loss or destruction of the interior or exterior of the house in three large fields, theft of property and responsibility for bodily injury.

The rent can help the tenant to protect the tenant from the economic loss due to the theft or loss of personal articles.

What Are The Factors That Affect Home Insurance Premiums?

The tenant’s insurance covers the personal wealth and the liability for the tenant, while the homeowner covers the owner of the property for the loss of the property, the personal responsibility and the rental income.

Unless there are special circumstances, an owner is not obliged to provide the property. Such a circumstance is the owner of housing who has a mortgage. In general, these owners must take the Lisi insurance policy that protects the mortgage. The creditor is protected by the mortgage clause in these policies.

House owners often establish that tenants receive tenants insurance in the rental contract. As we ensure several significant assets with the insurance of household owners, the costs will be higher than the rented insurance. Most of the rented insurance owners and insurance policies also have to cover their associated responsibility in Lisi.

Writers must use primary sources to support their work. These include interviews with white books, government data, original reports and industry experts. We also refer to the original research of other renowned publishers wherever it is adequate. You can find out more about the standards we respect in the construction of precise content and partisan in our editorial policy. One of the most serious experiences for a homeowner is to submit a home insurance application that it is not covered. After years of payment of a premium, the insurance company is not delivered when it is the most necessary. What a disappointment.

Calculating Home Insurance Premium

This is disconnected, because we rarely have time to review Lisi’s home insurance policies every year. With confusing conditions, such as the effective value of the cache (ACV) and the value of the replacement cost (RCV), it is easy to overlook the details.

But as a financial samurai, it is always crucial to be prepared for the worst. Whether you expect your family to protect your family from an internal invasion, find an amazing car collision scandal or expect the next mayor to push the pressure, regardless of the challenge, regardless of the challenge.

Let’s review some basic home insurance. If you have a mortgage, you must carry insurance for your bank, for which you pay. However, if you have full property on your home, you are not legally compulsory to maintain coverage.

Below is under the instant of the Lisy insurance policy, at the price of $ 3, 900 a year and I will go through everything.

The Best Home Insurance Rate And Shopping Guide In Texas

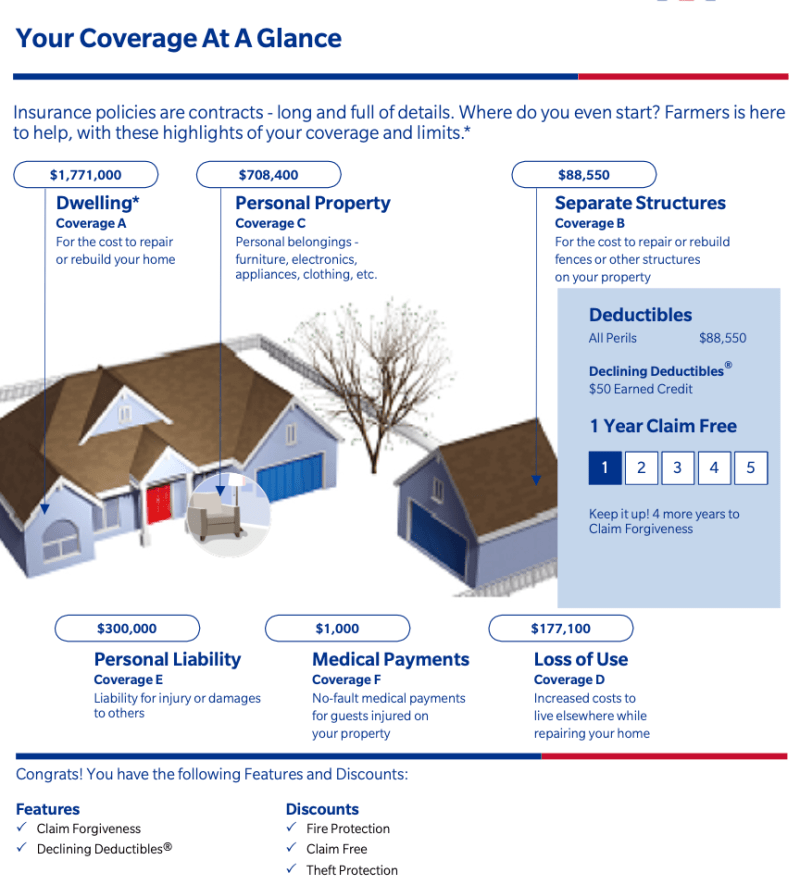

Covering the residence is the necessary amount to repair or recreate the house. In this example, the coverage of the residence is 1 dollar, 771, 000 for a house of 4, 800 square meters, which translates into 9369 on square square. It is important to calculate this and compare it to the current cost of construction in your area.

In San Francisco, 9369 on the square is low, but it is high in places like Little Rock, Arkansas. According to Farmer’s Insurance, the industry is close to 602 per square square in San Francisco. Ask the Housing Insurance Agent what is your city’s standard.

If you live in an area where property values and construction costs increase, coverage of your residence can gradually become insufficient. Some insurance companies automatically adjust their coverage every few years, but in many cases, you must confirm that the coverage amount is accurate.

Below is a breakdown of the way they reached 1 dollar, 771 000 000 in covering the residence. This breakdown also provides information on the cost of reducing an unknown house.

Debunking Home And Auto Insurance Myths

Personal property insurance covers your luggage – furniture, electronics, appliances, clothing and if you turn it on a sidewalk, your home will come out. In this example, the coverage of personal property is 8 708, 400, which represents 40% of the residence coverage.

! Many policies have established the coverage of personal property as a percentage of the residence coverage, often with 40% minimum.

This approach is in the U.S. The client offers an interesting look at the culture. Insurance companies depend on millions of receivables for establishing this percentage of reference.

Personally, I see 8 708, another 400 for my luggage. Except for collectors (coins, books, sports memories) and family images, my house is not a significant value. We don’t have expensive designer or art furniture. So, if a thief would have targeted my house, they would be disappointed.

Home Insurance: Buy House Insurance Policy Online In India

For those who follow the least lifestyle, like many personal finances, this cover looks great.

This covers the cost of repairing or reconstruction on your property, apart from the main house, such as a fence, barn or a separate garage. It is important to specify with your agent that the garage attached without living space is considered as a separate composition. In most cases, it should be considered part of the main residence.

Personal liability cover protects you if someone is injured on your property or if you are legally responsible for losing another person’s property. Here are some examples of what it can cover:

For those who are often distracted at home, covering personal responsibility is crucial. In this example, the coverage of the policy includes $ 300,000, which seems reasonable. However, if you host a big party and your balcony is broken, it can be quickly tired of $ 300,000.

All Secure Insurance

If you think that covering personal responsibility is not enough, then you certainly get a umbrella policy. The umbrella policy goes beyond the car insurance and lisy insurance policies.

Losing use of use is essential, because if your house becomes deserted, you will need a place to stay. Depending on your location, it may take years to get and reproduce authorizations.

To calculate your needs, estimate the monthly rent for a comparative house, you think you multiply how long the reconstruction construction will last, and then the construction often takes longer than expected.

For example, if the cost of renting the same house is $ 5,000 per month and expecting a 12 -month reconstruction, multiplied