Home Insurance Florida – Let’s receive the Condo Insurance from the list of work. We buy. You will be saved. The best value protection plans are only click.

Conducted insurance or SP-6 offers the provision of credit calculates, protection of domestic and personal affairs and personal affairs. Contrary to the house insurance that includes the events, fire and damage, personal, and responsibility.

Home Insurance Florida

Review of florid weather conditions, such as storm, Kido insurance is necessary. The Connouncement Weapon covers the walls, floor, personal work and responsibility at the smart cost.

How Much Are Home Insurance Rates In Florida Rising?

Florida Rate Retal Sustainable Insurance is approximately $ 1, 130 per year, which is very high than the average country. This is due to several factors, including the state sensitivity to serious weather events such as storms, which increase the danger and so award. However, these expenses are very different depending on the location. To achieve a better understanding of these expenses, it is recommended to request the Conduct’s Sign Insurance tariff.

For example, in large cities such as Miami, the average annual price can be about 2, 570, it’s about 1, $ 050 dollars. Prices are also different in smaller cities and cities. For example, Boca Palons will see Mabal Myination Mabal worth $ 2, 110, while it is about $ 780 less than a year.

These varieties affect the factors such as local weather models, buildings and the economic impact of important events, such as the collapse of hypos. Understanding these costs can help budget owners and seek better insurance policies to meet their needs.

What are the amazing services and prices of awesome! I can’t recommend them that they really appreciate the service that they can give my customers. Thanks darritch ust

Republicans Are Coughing Up Billions To Save Florida’s Home Insurance Market

Alexander Lopes and Insurance Provide me with a great service. He answered all my questions and even compiled some of the tips I can save money. He prepares my confidence in my needs. I am very recommended that if you have a trust you call the insurance value.

Chase was so effective and friendly. Make an Insurance of Customer Services to give me money. 5 stars! Definitely recommends for all.

We are here to help you receive more of your insurance. The value of despair from the first hand with home insurance. Our processes and teams make it easier and find the best rules of value and protect against unexpected. Let’s take insurance at home to say greeting the mind peace.

The first section of this protection provides protection for the current home. To limit the value of this protection to the minimum amount determined by your home to restore your home.

10 Best Home Insurance Companies In Florida: 2024 Guide

Another part of the structure protects other items in its property, such as the walls, seals and garages. Typically, this protection puts out about 10% of your Protection, but should be corrected if the need to limit the restrictions of protection restrictions.

The easiest way to describe this if the house is down and turned out how it will be sold. Examples of personal care features include furniture, electronics, clothing and toys.

This protection offers the additional cost of life that makes the danger of your house that makes it weaker. In this case, you need to move from home and rent the room in the middle of a different car room or hotel.

In this regard, protection provides protection against such work accounts and legal payments if someone is injured in their property or in case of injury, including if your dog is bite. Certain factors can harm your home in this regard. Examples include Trumpolines and pools.

Home Insurance Claims In Florida: Roof & Water Damage

In this section protects for small medical payments to those who were injured in your property. The usual amount of standard policy protection is limited to a claim for $ 5,000. This part of the policy to give payment even when the accident was not your sin.

Understanding the policy of the Cooperation Association is important to ensure personal guarantee. Master policy usually places the general responsibility and the damage caused for usual areas, such as roofs, lifts, and hoodwws. Protection may differ from outdoors to the internal features of individual units.

In Florida, the Union of Aquaria should damage the damage from natural disasters, such as storms and floods. Magist policy covers the buildings with public areas, but usually has personal assets or secular injuries to individual units.

Unit owners need to know the features of the master policy to ensure the appropriate inclusion of personal insurance. Law requires that the Redon Union requires the sum of thunderstorms in the rules, notify the unity owners of potential financial liabilities.

Navigating The Process: What To Do If Your Florida Home Insurance Is Cancelled

The Florida Law is not required for separate owners and does not require personal choice. However, the mortgage lenders require a policy of politics and protect the financial interests of the credit credit to the property.

Some associations may require insurance requirements for units, quality and amount of insurance. Therefore, while the state is not required by the state, you need to be funded by mortgage financing or conditions of Kondo insurance.

Condo insurance or Condematical Insurance, protects you and protects your unit from financial losses in the case of coverage.

Most countries do not require credit insurance but may be protected to your mortgage creditors. Besides, Hutun can have protective requirements.

Fort Myers, Fl Homeowners Insurance: Get A Quote From Kin

There are a number of discounts that can be available for your coupo insurance policy. These include some policy-distributions, security system discounts, claims of discount or free discount requirements and free. Discounts differ by qualifications and state.

Khubamic insurance usually protects in the case of the following danger: fire and electricity, storm and ring, ice, snow and snow. Rules are different. Check your rules for approval.

The master policy for the housing building usually is usually called your housing associations (still) home property insurance. This policy should define the structure of the building, general areas and defend responsibilities.

Agreement Transfer is a promise to pay for payment in the case of losses of coverage, so policy protection standards.

Make Your Voice Heard: Stabilizing And Improving Florida’s Home Insurance Market With Your Help

Liability Insurance may be part of your Coupo Insurance Policy. This protection helps the physical injuries, medical payments and legal costs. See Protection and Excess Policy.

On average, you can apply your ship insurance for the cost of 200 to $ 500 per year. However, if you have a large ship (such as ice or boat boat) to send 1-5 percent of the value of the value.

Typically, the mortgage lenders require approximately 20% of the value of the property value, which is the “FEZ”.

Contracting Condo covers everything. Ukominic insurance does not provide flood damage, property tenants or vehicles.

Hurricane Ian Is Pushing Florida’s Insurance Market Toward Collapse

Home Home Insurance covers the voices, this is a secular Gardle, Back and Outdoor walls. Credit insurance policy as a “wall” is known and recognized the personal property with limited elements in Florida. This is a wave of insurance premiums mainly by various factors, including irrigation, inflation, excessive conflicts, excessive prizes, and changes in the speed. What are the reasons for raising the property insurance cost in Florida? What does it concern for residents? We research and talking to experts to answer these questions, as well as solutions to solving financial tensions.

Florida is not alienated, and other storms and other natural disasters have a significant risk to the owners of the. According to the Ocean Administration and the atmosphere (Naaa), 308 USAIDS. US 2022 to 20%. More than 40% of these storms were in Florida1. More storms from Texas is more than Texas, the second condition is damaged by the next.

And things are not slow. Up to 2023, Naia, Naia in Florida foretold 30% in Florida with a higher preparation of higher preparations. After three months, NOAA feels 60% of the Florida’s ability to make a higher supreme season.

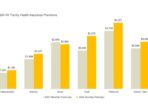

The high frequency of these measures has led to the increase in construction costs, as well as higher costs, which has led to rehabilitate and replace damaged houses. Information institute was a project that due to inflation and the duration of the following activities, the property insurance rate up to 40% up to 40%. Florida insurance rate is almost four times to average four times. The government residents account for $ 6,000 for housing insurance companies, which is the contrast of the national tie from $ 1.700.

What The Heck Is Going On With Home Insurance Rates?? I’m In The Tampa Area, Anyone Else’s Rates Look Like This?

Insurance fraud and too much matches