Home Insurance Gone Up – Have you ever made high standards that are moving over time, even if you haven’t made changes to your policy? This is normal and happens for many reasons, such as ownership costs, financial changes, mobile weather standards.

With all the emotions of these days, many are looking for ways to minimize their ancient and automated values. A good place is a good place to start insurance discounts, but we will take care of your preferences.

Home Insurance Gone Up

If you describe an increase in the value of your home or change the policy limits, you can see higher insurance prices. This makes your home more expensive to enhance insurance, so the insurance company must also be exactly what you have from you.

Why Has Home Insurance Gone Up?

The ancient owners are to measure homeowners based on the value of the building and the cost of repairing or recovering it. Problems of providing, inflation and economic factors can increase the cost of building materials. In this case, the cost of rebuilding your home after a loss is also increased, leading to a higher annual price.

Just like materials, the price of work is part of your insurance charges. When staff are specialized, plumbears and groins built at a pace, cost to fix your home.

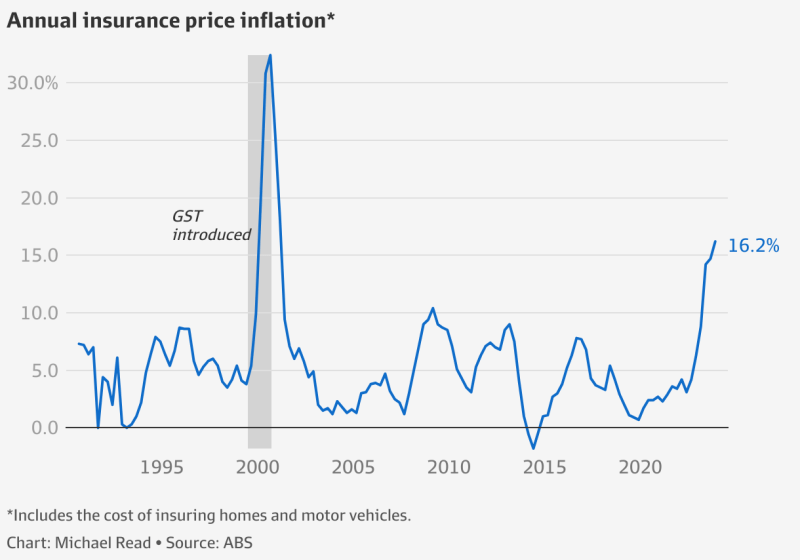

Just like home insurance, trim price and work price are automatically infusion. Car parts are becoming more and more difficult to find and an engineer increases more for their work – 2023 The highest jump at 20% in 1976 was in 1976. *

Distance, forbidden driving drivers and abyss driving vehicles drive expensive accidents. When accidents increase and pay payment payment, so create insurance prices. Whatever your personal driving table, life in an area with high trade rates is your prices.

The Housing Market’s Insurance Shock, As Explained By Corelogic Chief Data Officer John Rogers

You can have a great move to your insurance levels, for example, move to an area with higher or more traffic levels. Even a price of your neighbors can increase your insurance levels, as you make sure you have enough transmission to protect you if the accident is protected.

Nothing affects the traffic accident that wants to hit a disabled or subcommittee. When this happens, he and your insurance provider in a situation to take on financial responsibility for damage – even if you have not destroyed. By adjusting an expanded contribution to your policy prices, but can reduce a good way to reduce the amount of accident.

Insurance contracts protect against bad times such as Tornch, Hars and Wild Image. According to NOA, the US has become accustomed to destruction of 10 or more billions of dollars per year for the last eight years.

Frequency and severity can affect these disasters have a serious effect on both home insurance and youuto insurance. As the weather continues to change, there will be insurance levels for people across the country.

Environmental Defense Fund

Fortunately, there are many you can do to get to get tasks and save on your insurance charges. Whether home or automatic, here are some things to try:

Make sure your policy covers all the necessary things, but you don’t pay for broadcasts you don’t need. For example: Removal of shed, bathroom or other beach from property allows you to your insurance needs. When you do this type of change, make sure you update the insurance policy to ensure that you pay for proper coverage.

Is to remove the amount you are responsible for paying after loss. For example, say that you cause a disaster that becomes a reality of $ 2, 000 in your car. If you have $ 500, you will be responsible for the payment to pay this amount while you are covering your amount responsible for the amount you are responsible for the amount. However, it can be a good way to save monthly insurance costs if you are a safe driver and tend to end in an accident at AT -Cilt.

Speaking of discounts, most insurance company providers offer driving, faith, faith, market, market and further policies. Independent insurance insurance can help and register for the discounts available.

Has Your Homeowner’s Insurance Premium Gone Up? Rates Have Risen Across The Country, But These Five Tips Can Help You Cut Costs. ✓ Comparison Shop Each Year To Make Sure Your Price

Another good way of saving your aircraft automatic prices to study your payment options. Many insurance providers who offer full discounts for drivers choose a payment instead of breaking the monthly rights. In some cases, you can even find discounts to set Auto payment instead of paying a monthly payment.

Insurance companies often offer faith, so the easiest way to survive often survive to wrap your policies. This means that insurance owners, commercial instructions, automatic policy and any other coverage may be needed with the same provider. It saves you if you have to apply and you can be a good way to save money.

Talk to an independent Agen today to see how you can save your home and automated insurance.

This is only for information purposes, it is not part of your policy and is not a promise or promise to cover. If there is any conflict between this information and your policy, policy arrangements will be used. The terms and conditions may apply to the insurance policy. Politics offers can be related to policies, supports or riders. Cover can be changed according to the state and can be changed. Some products are not available throughout the situation. Read your policy and contact your substitute for support. Factors affect the cost of rebuilding reconstruction houses, leading to higher prices and the need to transmit labor. Talk to your independent production to make sure you have the correct amount of coverage and enough away.

Tariffs Threaten To Push Us Home Insurance Rates Even Higher

Larger houses, upscal: The interior of a house has been further improved with the custom tagged Tuggie, full when the Domanard is new.

Hard weather: There are 18 weather conditions (weather conditions) from losses that cross $ 1 billion damage. The increase in bad weather caused by 39% of UK insurance applications.

Higher elements Cost: A mandatory average of 26%average material, the houses were more expensive to be installed and replaced.

Increase in water damage: water damage and water loss increased over 10% from 2017 to 2019.

Why Home And Auto Insurance Rates Are Rising In 2022

Fire damage: On Saturday House Homes burns closer to 6 times faster than the old synthetic cost and floor open.

Increased shipping and delays: Rays have affected almost all parts of the global supply chain that cause the delay chain and higher trees. 95% of companies made 1000 companies that went through the CVID-19.

Higher Work Fees: Almost 90% of contractors find it difficult to look for craft workers and 88% of companies. Higher Councils manage the price of products to increase home insurance

All subscribers are registered by their insurance company or an insurance company (“The”). The broadcast may not be available to all sovereigns and is subject to the help of the company’s subscription and implementation policy. This material is provided only for information purposes and does not provide any broadcast. For more information on our site in. © 2021 the insurance team. All rights are maintained. Sources: Noaa, American Business American, Industruation Information, Meetings, New Homeparts

Why Did My Home Insurance Go Up In Michigan (2023)

Our friends from the Plymouth Endmouth Endmouth at ARC had been sent to ARC for why home insurance prices increased. It was very utility and decided a similar article.

Homeman is in his dream for many, offers stability stability stability and comfort. But with this dream comes, and one important thing is important to get proper insurance. Unfortunately, many Rowors are powerful from homeowners, especially in the ina invention – home insurance prices arise. This may feel like a financial weight, letting him ask why there is a cost directly.

Climate change is not a distant risk. It is a fact that affects our daily lives and the surface of the house is such an exception. Massachusetts is influenced by Massachusetts between the test. This translates into an increase in home insurance applications, as these events cause significant damage to buildings. Insurance companies have been forced to change their prices and ensure that they can continue to support these risks.

The world organizer has taken large supply chains, affects the access and cost of building materials. Wood, tops, Mull cable and Dyke Coppers are just a few examples of suffering substances. Remember that the cold spelling that allowed a lot, such as a short disease? This delay extends repair times but also