Home Insurance Increases 2024 – Mysterious production production in deceleration in the United States Danial Lashkari and Jeremy Pearce Banco de la Federal Reserve in New York

Labor productivity in the American production sector between 1987-2007 increased by 3.4% per year, but decreased by 0.5% per year between 2010-2012. Even the fastest growing industries and the largest companies have experienced a slowdown.

Home Insurance Increases 2024

Most production industries, even those that show an increase in the productivity of star productivity in the 1990s, suffered after a great recession that permanently slowed productivity, especially surprising due to the wide acceptance of automation and The robots. [It seems that the four largest companies in all industries] in the 1990s played a more important role in the expansion of productivity. In the case of these companies, the average growth of labor productivity was 3.7%in the period 1987-2007, while the monitoring of companies in Commentšat recorded an increase of 2.9%during the same period. From 2010 to 2022, leading companies are also led by the following companies decreasing in productivity growth. The leading companies show an average growth rate of –0.5% in the second period, a decrease of 4.2 pp, while companies are experiencing a growth of –1.3%, as well as a reduction in 4.2 pp. It seems that the slowdown in productivity is a broad phenomenon that affects all sectors and all companies in each industry. These findings have been different from the recent findings in literature that focus on large companies that separate from smaller companies. Although there is evidence of this department, it seems mainly of growth in 90 and early 2000.

The Ultimate Guide To Understanding Rising Homeowners Insurance Rates In Alabama

The growing growth of the immigration population can have little impact on Anton Chesmukhin, Sewon Hur, Ron Mau and the Federal Reserve Bank of Alexander Richter in Dallas in Dallas

The @Dallasfed analysis found that “during the last year, the wave of immigrants has contributed to the highest growth of GDP by adding almost 2 million newly used workers … with a little effect on inflation.”

If immigration increases the population by 1%and these newcomers are integrated into labor in rates comparable to citizens born, both employment and production are extended immediately. If there is no capital, such as a production factor (machines, plants and equipment, employees, production and consumption, each would extend by 1%, the balance of demand and supply, maintaining the stability of prices and maintenance of GDP per capita would not change. 1%, which is only built over time. Probabilities of accepting manual work, the need for capital accumulation is reduced, softening inflative impacts.

In spite Historical range.

The Housing Market’s Insurance Shock, As Explained By Corelogic Chief Data Officer John Rogers

In the short -term duration of recent over -the surges in the area of immigration and participation in the workforce, the current level of employment growth in the area of employment increase increased to 230,000 jobs/month. Our basic calculations involve an long -term unemployment rate of 3.8%. It is estimated that the growth of short -term employment is greater than long -term growth within each scenario, as shown in Figure 3. According to the basic scenario, it is estimated that the growth of short -term employment in Breakevev is approximately 140,000 jobs/month. First quarter 24 (dark blue line). It is significantly higher than 230,000 jobs/month in the high CBO immigration scenario (red line), reflecting the recent increase in immigration. As part of the basic projections, the short -term equilibrium growth is converged with a long -term rate (gray line) until the end of ‘25. However, this return to the long -term trend extends further to ‘27 for the high CBO immigration scenario. It is estimated that the long -term growth of employment in the area of an increase in ranges between 70,000 and 90,000 jobs per month in ‘24

State regulators are a green lighting of a two -digit increase in household premiums in an effort to prevent insurance companies from retiring from their markets. The average household insurance contract increased by 20% nationwide this year.

Last year, insurers of origin raised a loss of subscription of $ 16 billion, the largest amount of at least 2000, according to AM Best. Wait for losses to continue. The states also provide home insurers almost everything they require for rates, indicating an analysis carried out for the Wall Street Journal. According to S&P Global Market Intelligence, the average increase approved by the State since the beginning of last year is only 0.2 percentage points under the increase in the required industry. Ten countries where regulatory authorities can reject requests in advance since the beginning of last year, the two digits increase in green lighting, half of these increases near or higher than the national average of 20%, show S&P data. California, who has maintained a adjusted domestic insurance for decades, has approved an average rate of 21% in a given period, according to S&P data.

.

The Insurance Crisis Continues To Weigh On Homeowners

Legislators must be addressed in 2025 as an opportunity to accept sustainable fiscal growth for growth. They should try to reach three goals. First, focus on income neutrality or a law that does not increase or reduce federal income. Second, build on the strictest aspects of TCJA. First, legislators should restore 100% bond depreciation, ideally permanently. This provision is the only best -selling policy in the law. Legislators could increase their growth potential by extending other assets. Third, further clean the fiscal law. Even after TCJA, the federal government still loses more than $ 100 billion a year due to detailed deductions. Legislators could almost equally increase the cancellation of the new green energy taxes introduced into anger. The deduction allocation for passages with an approval would reduce the cost of expanding the law by more than $ 600 billion.

The household insurance market in 2024 registered great challenges, with increasing bonds and a growing exit of transporters and restrictions that continue to influence owners, mortgage entities and the real estate market as a whole. Read more to investigate how these trends appear, explore the latest data, obtain information on how the regulatory authorities and related industries respond and understand where the market could go in the near future.

Climate change was a key factor that contributes to the current crisis in the household insurance market. The frequency and severity of catastrophic events such as hurricanes, fires and floods have increased, leading to greater costs of insurers’ claims. It is reported that in 2023 it registered $ 28 billion and climatic disasters in the United States, thus exceeding the previous record established in 2020. It is estimated that in 2000-2016, more than 79% of the growth of the United States in coastal states occurred in coastal states, which promoted insurance companies.

Insurers are increasingly difficult to manage these risks, which leads to higher insurance and lower coverage availability. It also worked for the loss of loss for the industry, while insurers faced the growing speed of growing claims.

Post-claim Home Insurance Increases Explained

In 2023 there was a strong increase in the restrictions and selections of operators of certain markets. As climate change has led to a greater number of natural disasters and inflation increased the cost of construction, insurance companies tried to remain profitable. To cover losses, carriers have tried to increase rates, but have often found the refusal and delay of the State Ministry of Insurance (DOI), which must approve any increase in premiums. Many carriers have found these regulatory challenges and the inability to cover costs, has begun to limit or stop writing new policies, especially in high -risk areas. This adjustment of the instructions to subscribe and reduce businesses has led many owners who tried to provide coverage.

This trend in 2024 had a permanent impact on housing owners. Recent research shows that approximately 6 million owners lack insurance, so it assumes an extreme financial risk. One of the contributing factors could be a decrease in policy capabilities. The average number of insurance offers available per person in the US. The market can begin to stabilize (more about it later).

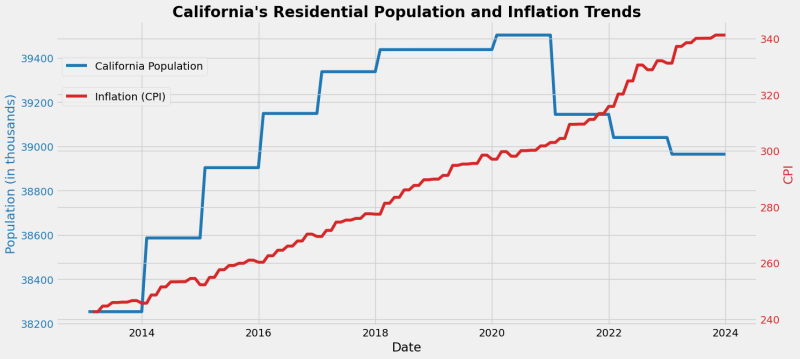

This problem is even more pronounced in high -risk areas and those that have a demanding regulatory environment. For example, California faces the risks of fires, floods and droughts, along with important regulatory challenges, which makes it difficult to covet the cost of claiming costs. In response to the main companies such as State Farm, Allstate and several others left the State in 2023, with other insurers such as Hartford, which followed the lawsuit in 2024.

Even housing owners with insurance could be in an uncertain financial situation if their coverage is not updated. It is estimated that approximately two out of three houses in the United States are insufficiently insured, mainly because the owners do not regularly update their policies to reflect the growing costs for the reconstruction or improvement of houses. The latest data