Home Insurance Monthly Cost – Household insurance is an important part of financial security, and many suppliers should be taken into account. On the one hand, the best insurance carriers have financial power, customer service and appropriate proposals in the event of a disaster. On the other hand, the competitive pace should not break the budget. This last point, the average cost of insurance for each state owners in 2020.

For most, their home is their most important asset. The only way to recover from the family disaster was properly insured. Therefore, homeowners insurance is needed for financial security. We have found a medium pace by 2020 in each state, “scientific education”, financial education and product comparison. The imagination of achievements for each state of the country allows you to easily see if you are well aware of such an important part of your personal finances.

Home Insurance Monthly Cost

In the Tornado Alley, states have insurance rates of owners of the country in the country. Oklahoma is distinguished as the most expensive, with an average of $ 559 a year. Kansa and Texas both have high rates (respectively, $ 2, $ 461 and $ 451). These states are not only tornados more often than elsewhere, but they are significantly stronger, stronger than above. For example, Oklahoma’s city only hit two or more tornado 29 times. These factors are usually much more expensive for homeowners.

What’s Happening To Home Insurance Premiums?

At the other end of the spectrum, there are handful states where less than $ 1 costs less than $ 1. Many of these places are clusters in the northeast, such as Vermont ($ 614), New Hampshire ($ 773) and Maine ($ 849). Delaware contains cheap rates in the country for only $ 598 or about $ 50 per month. This is about half, as the average American spends a cell phone, according to the latest Bureau of Consumer Consumer Consumer Survey.

The cost of household insurance falls between the two extremes of most states. In general, most people may expect to pay from 1 to $ 1 to $ 2, 000 to 000. However, it is important to remember that insurance for homeowners usually does not include floods and earthquakes. Anyone who suffers from these types of dangers should take into account additional coverage types.

If you are in the household insurance market and need help to find the right coverage, check the guide on our homeowner insurance. He always pays for shopping and finds the best company for you.

They are for sale soon. We will send you an email when you are ready, just leave your address in the box.

The National Average Cost Of Homeowners Insurance Has Been Steadily Increasing Yearly. Learn What Factors Impact Your Home Insurance Premium And Are Beyond Your Control, Click The Link In Our Bio. . . . . . . #

If you want to use our reflection in books, magazines, reports, educational materials, etc. Practice to establish an insurance premium on the location of the property. Insurance companies use postal codes to evaluate the risk that is related to the involvement of a home in a particular field. The factors of discussion include crime indicators, the risks of natural disasters, and the overall importance of life.

To determine home insurance, postal codes allow insurance companies to more accurately assess the risk of property insurance. This leads to the insurers for a larger reward because they only pay for the necessary coverage. In addition, it helps to make insurance companies resources to pay a claim in the event of a disaster.

When buying home insurance, it is important to compare the pace of many insurance companies. This will help you find the best cover at the most affordable price.

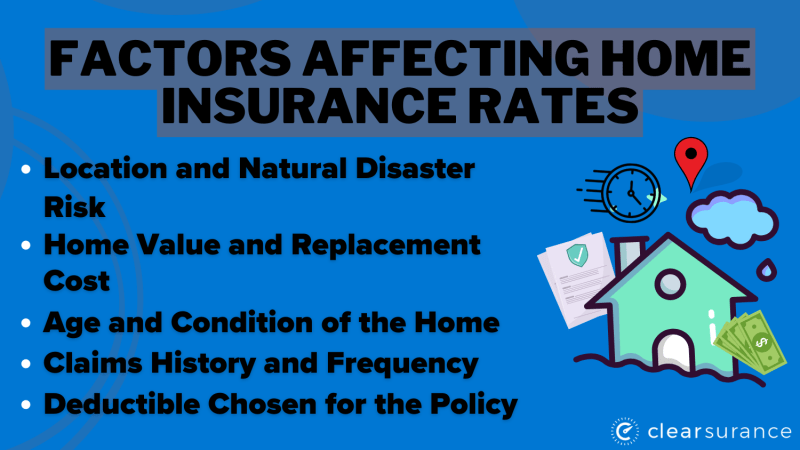

Home insurance prices are determined by ZIP code with various factors, including the following main aspects:

Best Home And Auto Insurance Bundles In 2025 (top 10 Companies)

All of these aspects are used by insurance companies to assess the risk of home engagement in a particular field. Given these factors, insurance companies can determine the pace that are fair and accurate. For example, under the risks of high crime risks or disaster risks, houses will usually have more insurance rates than homes in safe areas. Similarly, houses that are in greater condition will also have more insurance rates than in new homes.

It is important to know about the factors that affect home insurance pace. Understanding these factors can be sure that you will get the most affordable coverage at the most affordable price.

The level of crime is the main factor by placing home insurance interest rates. This is because the crime rate is a good risk for insurance companies. In the areas of high offenses, houses are more robusted by vandalized or other damaged criminal activities. As a result, insurance companies pay higher prices for homes in these areas to compensate for risk.

The link between crime rates and home insurance is justified. Studying the Insurance Institute has found that homes are 10% more likely to be in areas of high crime. In addition, in areas of high crime, houses are 20% more vandalized than the houses of suffering areas.

Average Cost Of Home Insurance

The practical meaning of understanding the connection between interest rates and home insurance interest rates is that this will help you make informed decisions about your insurance coverage. If you live at a high level of crime level, you should consider buying a home insurance policy at a higher level at a higher level. This will help you protect you from financial loss when your home is damaged or destroyed by criminal activity.

Natural disaster risks are a major factor associated with home insurance by postcode. This is because natural disasters can cause significant damage to houses, and insurance companies should assess the risk of this damage.

The most common disasters at home insurance pace are storm, tornado, earthquakes and floods. These disasters can cause great harm to houses and they can lead to loss of personal belongings. As a result, insurance companies pay higher prices for homes that threaten these disasters.

The connection between natural disasters and home insurance rate is based. Studies of the Insurance Institute have found that houses in high -risk areas of natural disasters are 20% more harmful to natural disasters than low -risk disasters.

Average Cost Of In Home Care

The practical meaning of understanding the connection between natural disasters and home insurance is that this will help you make informed solutions about your insurance coverage. If you live in a field that threatens the risk of natural disasters, you should consider buying a home insurance policy at a higher cover level. This will help you protect yourself from financial loss when your home is damaged or destroyed by natural disasters.

The cost of life is the main factor by determining the level of home insurance. That is, the cost of living in this region is a good indicator of the value of home repair or change in this area. For example, in areas with high live livelihoods, houses usually have higher insurance rates than houses at a low price.

Understanding the cost of interest rates on live and home insurance will help you to make informed solutions to cover your insurance. If you live at a high price of life, you should consider buying a home insurance policy at a higher cover level. This will help you protect yourself from financial loss when your home is damaged or destroyed.

The neighborhood of fire hydrants and firefighters is an important factor for determining home insurance prices by postcode. This is because the distance from the nearest fire hydrant and the fire station can affect the time needed for fire. The shorter the distance, the faster the reaction time and the unlikely it is to cause a great deal of damage to the homes.

Which’s Simple Steps Show You How To Source The Best Home Insurance Policy For You

As a result, insurance companies pay low rates for homes located near fire hydrants and fire stations. For example, the study of the insurance institute found that 1.00 feet of 1.00 feet fires in the fire hydrant have a home insurance level, which is 10% lower than 1.2000 feet with fire hydrants.

Its practical importance is that homeowners can save money on their home insurance, chosen to live a home near a fire hydrant or fire station. This is especially important for the owners of the house who live in large -scale areas for fire.

Age and condition