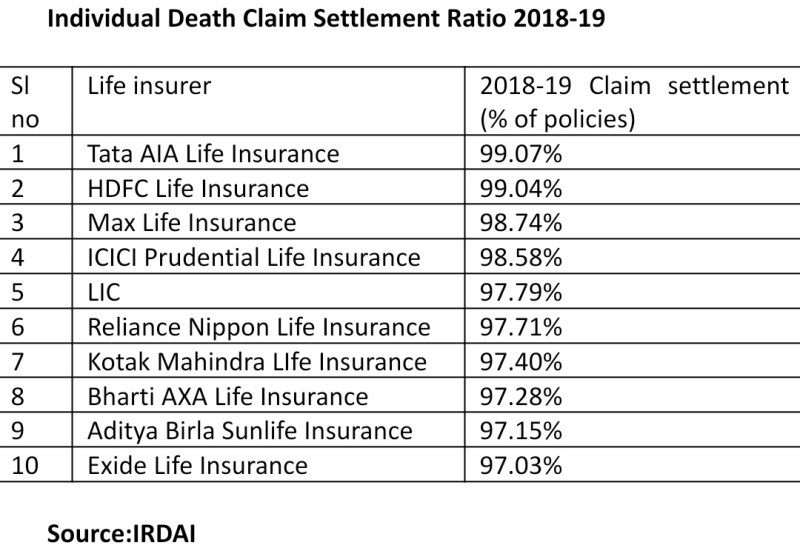

Insurance Company Claim Settlement Ratio – The latest annual Report IRDA published on January 9, 2019 gives all the details of the settlement of complaints for life insurance companies in India.

One of the most important statistics of the insurance company. The main obligation of the insurance company is to settle complaints, quickly and carefully and give the amount secured to the Lessee’s candidate for the presence of an unfortunate event secured.

Insurance Company Claim Settlement Ratio

Irda published the latest annual report for 2019 – 20. Read a complete analysis of the last performance of the settlement of claims for insurance companies in India.

Health Insurance Companies Claim Settlement Ratio

The complaint’s settlement ratio is the percentage ratio between rules and responsible rules that have been received in a given period. For example, if the company receives 100 complaints whose 90 complaints are paid, the ratio of complaints is 90%. The claims reporting report can be calculated on the basis of the object of the police to the complaint amount. The report on established complaints will give you a clear idea of customers satisfied with the company. In addition to add, the derivation of the Guardian insurance company is directly linked to the ratio of complaints.

According to the annual report published by IRDA, the ratio of the regulation on the claim to the death and the ratio of the complaint for various companies for 2017–2018 is stated.

These four parameters listed here will lead you to find the best life insurance company in India in terms of death. Click here to download the image of the complaint settlement ratio.

The Indian company Life Insurance Corporation, the only insurance company in the public sector in India, has once again set high standards and became the best company in terms of complaints when four parameters were taken. The refusal report / rejection of the complaint at only 0.67% is a commendable realization.

Care Health Claim Settlement Ratio

On the other hand, Max Life, which exceeded the complaints’ settlement ratio with 98.26%, rejected 4.47% of the liability complaint as a percentage of the complaints.

The worst reports of the statement of the statement came from Shiram Life and PNB met life. Rejected rations of complaints were 26.43% and 15.15%.

The ratio of complaints is the ratio between the “number / amount” of complaints that the company has completely rejected in comparison with the total “number / amount” of complaints. As we have seen, the ratio of complaint settlement gives an idea of the performance of the company’s death.

However, unstable complaints include waiting complaints + rejected complaints. Acced complaints can be paid later or be rejected. Therefore, the ratio of established accusations cannot provide you with the exact image of the company.

Pnb Metlife Reports 99.2% Claim Settlement Ratio For Fy 2024, Bfsi News, Et Bfsi

The refusal ratio provides a more accurate value of the company’s complaint and is more reliable.

LIC from India paid 98.04% of complaints based on the number of complaints compared to 95.24% of private companies as a whole. As for the amount of services, it was 94.45% and 89.44%.

Most companies settled complaints within 3 months. India Lic paid 45.17% of complaints up to 3 months and 44.64% within 3 to 6 months.

On the other hand, Mahindra Kotak took more than a year to settle 44.44% of death complaints. SBI Life also played badly and took more than a year to determine 38.89% of his complaints.

Top Health Insurance Company In India 2023

Conclusion: As the main reason for securing the insurance is to obtain the amount of complaint in the occurrence of unfortunate events, it is always advisable to select your insurer wisely. The complaint settlement rate must be analyzed by “number” and “number of services” to get a complete picture. The percentage of rejected complaints is also an important parameter to be supported. The Indian company Life Insurance Corporation, which is the only insurance company in public life, leads a graph and with coherent performance remains the most reliable company of all these fees.

Amulya jeevan arrogya rustshak banking articles banking Calcutors Harvested Settling Employer Employer Insurance Insurance Plans Poppers Payers Payers Pivate Insorers RD Return Return Top Redalov Calculation. According to data from Irdai insurance ULIP download 2019-2020.

The complaint’s settlement ratio shows that the number of payments paid annually by the percentage of life insurance companies from the total number of complaints they receive. The data do not reflect life insurance complaints raised after the second COVID-19 wave at the beginning of April 2021.

As a rule, complaints are made after the death of the tenant of insurance. The complaint ratio shows the number of complaints that the insurer has been resolved in relation to the complaints received. In other words, the complaint settlement ratio roughly shows the likelihood that the insurer will make a payment when the complaint increases.

Claim Settlement Ratio Of An Insurance Company Is Considered To Be Effective, If It’s More Than 95% #nowyouknow #clinikk #wordoftheday#claimsettlementratio #meaning #insurance #insuranceeducation #financialplanning #learnwithus #clinikkcare

The main reason for the purchase of life insurance is to ensure that dependent people will be sure of the amount or financial protection in the event of the death of the lessee. As a result, it is important to discover the history of life insurance companies in terms of death for death.

It is also as a check of the performance of the insurance company. “This latest documentation of insurance companies helps future customers to identify the service they provide to choose a good insurance company to be their insurance partners and assure that their complaints will also be solved without many problems for their families or recipients at the time of need,”

During the fiscal year 21, 21, 21, 836 complaints were reported, of which 21, 304 complaints were resolved according to the report, which is an average complaint ratio of approximately 97%(Irdai).

When the pandemic intervened, Irdai ordered all life insurance and medical companies to remove the complaints process.

Claim Settlement Ratio(csr) Of Life Insurance Companies In India

According to the report, Max Life Insurance was released to deal with a complaint with a ratio of 99.35%. The insurer was at the top of last year. Aegon life insurance and Bharati Axa life insurance arrived in second and third positions with 99.25% and 99.05%. The largest insurer in India, India Life Insurance Corp. In India, settled 98.62% of complaints and took fourth place on the list, in 16th position last year. Prayerica’s life insurance meant a ratio of 98.61% and arrived at the fifth.

There could be two reasons for rejecting complaints. The main reason is non -strap or facts incorrectly. Sometimes people tend to forget or hide their health problems leading to death. This often leads to a claim for rejection.

“The basics of life insurance remain the same in a given situation that every customer must remember, that is, they never hide or create health details such as existing illnesses, habits such as smoking or alcohol consumption when purchasing life insurance to avoid misinformation,” Gel explains.

Other factors could be non -paying bonuses, delay in complaints without mentioning the candidate, incorrectly, etc.

Nearly Half Of Health Insurance Policyholders Faced Full Or Partial Claim Rejection In Last Three Years: Study

It is also important to fill in the good details of the candidates so that your addiction does not fight to get a complaint. Above all, the candidate must carefully fill in the form to settle complaints with the joints of the right political documents and medical reports to avoid any delay or rejection. Many people simply examine the ratio of complaint and advice to the insurance company. In this article, let me violate certain myths and help you understand the complaints reporting.

Therefore, if the company acquires 1000 complaints in one year and in paying 985, its complaints’ complaint ratio for this year will be 98.5%. An important point to note is that it is a number of complaints, not the number of complaints.

In general, most people who want to buy a deadline are looking for this ratio because they are afraid to create a complaint in the event of premature death. However, the complaint’s settlement ratio is not the same as the “ratio of the settlement of the death”

All types of complaints are considered when calculating the complaints’ complaint ratio (in the case of life insurance).

Death Claim Settlement Ratio Of Life Insurers In Year 2015-2016

Here is the IRDA 2019-2020 report, where you can see the number of complaints for LIC and private insurance companies

One of the greatest myths concerning CSR (complaints’ ratio) is that the probability of settlement of complaints is. This is not true and often leads to an error of judgment of the insurance company.

CSR is just a way