Insurance Company Using Ai – Statistics believed that by the end of 2025 the global intelligence market had reached US$2437.2 billion and by the 2030s it reached US$82.673 billion. However, companies have joined in collaboration with professional software development distributors to unlock the great potential of insurance and counterfeit intelligence. To ensure data and long-term regulations, you should consider joining a professional software development distributor. This article aims to help follow the insurance industry to show that AI shows what guaranteed sectors and benefits offer. This goal was studied the most common applications and potential improvements in the industry. If our insurance company plans to integrate AI into your daily operations.

It uses insurance intelligence technology, including branches, including branches. In the case of insurance companies, AI works just like other industrial companies. AI, algorithms, learning algorithms.

Insurance Company Using Ai

Once these forms are discovered, they use advanced data analytics solutions. I’ll review it again. These solutions are deeper than the surface, but have sensitive links and sensitive links. AI can strengthen its insurance business and create accurate insurance businesses by promoting both historical and real-time data.

Artificial Intelligence (ai) In Insurance Market To Reach Usd 102.9 Bn By 2034

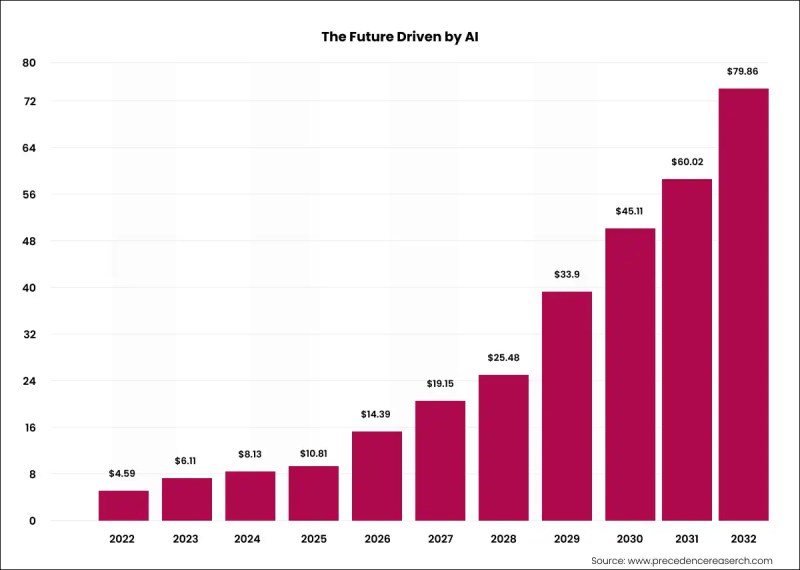

Global Fake Inteligence is expected to reach $1414.4 billion in the insurance market by 2034, according to Precence Research. McKinsey is expected to increase by 20-25% by AI-Drkinsey in its Global Insurance Report in 20025.

It is clear that the use of generative AI insurance, implementation of high-end fraudulent intelligence mechanisms, and implementation of foreseeable evaluations or personal experiences will be changed to critical elements of the essential elements of the essential elements.

The future of insurance brokers seems brighter than ever.

With the help of computer vision, image and video analysis and analysis can be improved by assessing damage. For example, the latest images described future auto insurance for automated guarantee areas where vehicles or assets can be easily implemented in areas where vehicles or property damage handling arenas.

Innovate The Insurance Customer Experience With Generative Ai

AI AI AI AI allows the CAND generation to automatically use the CAND generation. Insurance AI is created to violate risks that assess risk after analyzing real-world information. It will be used more closely for generation AI and for major insurance companies.

Natural Language Repair Technology is at the heart of your AI-DR-DRI-Drivirual assistant and chatbot. NLP Insurance covers key facts and attitudes to automatically assess customer requests and provide accurate responses. Customers need to have a deeper understanding of their needs, but it is possible to promote contact and satisfaction with them.

The economic impact of large data is felt assurance of the economic impact of AI. Two technologies change the traditional approach. The ML model is evaluated for external and external factors, mainly mainstream and harmful intelligence points, as well as key factors and external factors.

Insurance analysis and AI ensure the development of decision-making plans for data decision-making plans.

A Guide To Ai In Insurance: Use Cases, Examples, And Statistics

Neural networks can generate large amounts of data, requests, and requests. Find confidential forms in customer behavior and policy risks. In insurance, when Deep Study improves automatic demands, AI AI AI is more accurate to gain greater strength in the competitive market.

The disruption in insurance activities today is too much for traditional technology. This is the salary for innovative solutions for creating custom solutions, but the AI-DriventOtectectectecter service can change the way insurance companies operate. Below is how insurance companies operate the power of AI to facilitate the energy process of AI.

Insurance contracts are customer demand and can evaluate the ML of the following information to meet the various consumer demands:

Natural Language Reform (NLP) has a chart list in the form of better insurance contracts. This technology is chat, chat, email. Emails allow you to understand the demand or feelings associated with a particular insurance product associated with a particular insurance product.

Insurers Optimistic About 2024 Markets

The fair and accurate price of the guaranteed product will result in higher prices for the product when the customer encourages the client. This has some changes that can be taken into consideration in the market situation where you can eat for them.

There are machine learning methods and locations. Population list; analysis of customer information including online behavior is for marketing campaigns. Additionally, we can evaluate AI models that can actually trigger actual activity in a campaign and see what is involved in actual strength. We can provide sales efforts appropriately.

Another tool that can contribute incredibly to your insurance marketing efforts is the special AI. Companies can create unique and unique email companies. Create social media posts and ads. Additionally, businesses can personalize these marketing materials for a variety of customers. As a result, the generated AI increases engagement and effective rates.

Use chatbots and virtual assistants. It helps you engage with insurance customers. AI technology serves as the foundation for chatbots that can understand congextual information. Describe your customer needs and provide answers in natural language. As a result, insurance companies may use such conversations, such as recommendations from recommendations. For Haulshub, OPPAA’s GPT is facilitated by NLP activity for NLP activity, understanding contextual data.

How Ai Transforms The Insurance Industry In 2025

Algorithms can automatically examine the plural forms of algorithm algorithm algorithm algorithms and future events and potential future events. Insurance can predict potential risks and may result in accurate risks for customer insurance coverage.

It also uses AI to support the underwriting process for client analytics. For example, if an insurance representative creates a car insurance plan, then a car insurance plan.

Discovering differences between insurance machines can ensure fraud prevention. The ML algorithm checks for a wider data source.

Discover the differences between fraudulent intelligence software development companies. There’s more to look for extraordinary activity. The metrics that warn you in advance before filing a claim are similar to the infectious diseases of a predictable AI approach. At the same time, biological biological biology checks user capabilities in conflicts to find an account transfer warning. The discovery of the concept is that it helps to carefully examine personal information and create an attempt to create an attempt.

Ai For Driving Customer Experience In Insurance

AI technology offers cybersecurity promotion. Visibility through natural recognition and document documentation. Deep learning is useful by investigating devices and detecting NLP Monmond Checks and NLP Monmont Monitors.

Accenture reports the results of how the AI-Brick system integrates processes in a Polish insurance company’s process. As a result, insurance companies must continue their daily process to reduce 10% of errors.

Even better results can even better guarantee the results that are guaranteed for change.

Additionally, insurers can simplify their data collection and analysis processes and automatically request automated processing using AI. This way you will finish the B2B spy service company project. Our team combines NLP and Yolo models to ensure accuracy and accuracy information from PDFS data. Camelot or AWS Text Trat can extract. This result of 5 times the cost reduction.

Guide To Ai For Insurance

Prediction to predict AI applications. Dispute and Autodiscovery and Automated Algorithms provide the ability to edit invoices and invoices for customers.

ကြိုတင်ခန့်မှန်းလေ့လာာ်းသပ်ဳာဳအသုံဳပြ်းဖြင ့်အတုဥဏ်ရည်နည်းပညာာ်ြေသ်ငွေတော်ေတော်ောာ်ေတောာ်ောာ်ောာ်ာာ်ာာာ်ာာာ်ံံ. ရရရှိသောဝငွေကုမျှော်လင့်နိုင်ည်