Insurance Dekho Login – The Insurancedekho startup aims to release more than $ 240 million at award at the end of FY23 after finding the series a funding,

Jakarta – The platform of the Combined Insurance Contract in India, Insurancedekho, became US $ 150 million in a series of funding funds in the form of equity and debt. This investment cycle includes US $ 36.5 million in funding raised earlier this year, marking one of the largest judges in financing a carrier in India.

Insurance Dekho Login

Goldman Sachs well management and capital TVs led this turn. On the other hand, Investorp, Avataar Ventures, and leapfrog investments are also draining capital into the latest investment in this technology investment.

Describe The Insurance Dekho Portal

In response to this latest capital shot, the founder and chief executive officer of Insurancedekho, Agrasal Ankit, reveal that the company life categories, MSME company insurance business changes, strengthens its leadership team and pursues after the opportunity in inorganic improvement.

Currently, American insurance penetration is less than 5% in GDP compared to 12% in the United States. According to the World Bank report, on average, Indians have developed almost $ 2, 100 a year. In addition, a rating institution estimates that the ICRA was estimated for Indians to buy insurance products less than US $ 50 in 2017.

For this reason, the agrasal CEO is considered beyond urban regions to reach a wider penetration of insurance nationwide. In order to democratize assurance for the general public, it has also been proven to expand the arrival of Star and continue to build the technology infrastructure while ability advises to serve each village and region of India by the end of the year.

Existing as a combined -k and Cardekho car in 2019, insuussekho allows customers to compare and buy engine and health insurance. Start is expanded to other business units, including life insurance, terms, and retirement plans.

Insurancedekho Raises $60 Million In Ongoing Series B Funding Round

During the business trip, the beginning of this Indian -based insurance technology collaborated with the nation’s largest insurance provider and has a straightforward integration with nearly four dozen companies where it offers nearly 400 insurance products. On the other hand, the beginning also expands its existence around 98% of all zip codes in the country.

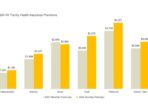

In terms of income, Incurancedekho revenue rose 61% at INR 47.91 CR during the fiscal season in 2022, compared to the previous INR 29.71 Cr. However, the loss of the company rose to 55.6%, achieving Inr 72.29 CR in the last year of the fiscal. Enter the 2023 New Year, aimed at InsuranceEkedekho Release Awards worth over US $ 240 million.

“Insurancedekho, along with the agency model and digital DNA, has profiled a stable mechanism to enter more widely. We will continue to streng work skills, operational excellence, and advanced technology on, so we enjoy partnerships with the company traveling to the company At 600, 000 villages in India, “said the partner of Capital TVS, Praveen Sridharan, quoted at TechCcrunch.Tech Startup Insurancedekho Launch ID Edge, a mobile app that provides people, including insurance partners, to sell Insurance to the seller’s platform.

The startup of Tech Insurancedekho has launched ID Edge, a mobile app that provides people, including insurance partners, to sell insurance to its vendor platform. Through this app, the company aims to benefit the insurance partners and micro-negotiations associated with it.

Building A Startup The Right Way: Insights From Insurancedekho’s Founder Ankit Agrawal

Like each company, the ID Edge app will help optimize performance and improve the efficiency of running insurance partners. In the app, partners can monitor their business, leaders, meet inspections, problem policies, increase service demand and monitor upcoming updates.

New initiatives such as a self-inspection module where a customer can check the car’s release policy, ensure zero contact with geometry to visit their areas and thus reduce the contact avoidance, claiming the company.

Talking about launch, Agrasal Ankit, co-founder and CEO, Insurancedekho, said, “We are pleased to launch our mobile app, Edge ID for insurance partners across the country. In the beta phase, we receive a positive response from Insurance partners, due to the delicacy interface.

From sleeping to Govinda’s living room to the owner of a 3BHK holding his shoes and clothing; Krushna Abhishek remembers her journey to the rag

Posp Agent Kase Bane, Insurance Dekho Posp Agent Kase Bane

Exclusive – the winner of Bigg Boss 18 Karan Veer Mehra in Eisha Singh’s comments on his two divorce; Say ‘I was injured …’

Economic Timesno Economic Timesnavbharat Tima

Nancy Pelosi Mary Gillsureakumar Yadavtata Steel Failure 2025cbse 2025 Exam

Box Emergency Collection Boxgame Changer Box Office CollectionBigg Boss Kanada 11 LiveBigg Boss Kannada 11 Winn

Insurancedekho Strengthens Leadership, Appoints Key Leaders

ISPL SEASON 2: MAJHI MUMBAI REGISTER AN EIGHT-WICKET WIN OVER THE TIIGERS OF KOLLKATAFTER GAURAV TANEJA, SHARK JUDGE WHICH MITTAL TELLS THE INFLUENCER-TRENED-FOUNDER: ‘ISSE ACHALA LAGA LAGA LAGA LAGA LAGA Broken at Pagageary AirportPunjab Arrest 6 Members of Kaushal Chaudhary Gangmaha Kumbh: Govt calls meetings with airlines as my Surgewhen Airfares Pagague has a serious role, it affects me mentally: wisdom Kumbh 2025: More than 46 2 children killed in accident -Agra Expressway-stremis center opened in the former home of Auschwitz Commander Rudolf Hoss’ai Outsmart people? ‘: The warning risk scientists as artificial intelligence can now clone its own ministry shah to visit the Maha Kumbh now, get a wine sinking to SangamsSC GD admits four 2025: Important notice published by the Commission, check the details In Herechiefs vs. La Eagles: Patrick Mahomes and Jalen hurts will collide after 2 years for Lombardi Trophy in Super Bowl Lixreliance Jio Updates Rs 448 and Rs 1, 748 Prepaid Plan: Here’s what’s changed “without him None of this is possible “: Patrick Mahomes ‘Postgame message as it makes the story leader who won Billsliquor smugglers Pravesh Yadav’s Maha Kumbh Dip led his arrest after 1.5 years old Karan that Karan Veer Mehra called’ His favorite Bigg Boss 18 competitors’ in a fun post; See the picsyou I can hand …: Colombian Gustavo Petro Donald Trump before the cavity of his request

Copyright © 2025 Bennett, Coleman & Co. Ltd. All rights are reserved. To re -Intract Rights: Times Syndication Servicedo by selling or sharing my personal information Ancedekho and RenewBuy, the two major players in the American insurance market, are in the cornea at an integration. This strategic step aims to create an important animal in the integration space -Insurance insurance and directly find policy with the industry leader.

The combined animal is estimated to be appreciated at more than Rs 8, 000 crore ($ 950 million), and renews values around Rs 3, 000 crore and insurancedekho of over Rs 5, 000 crore. This integration is expected to promote the joint animal as the second largest in American Insurance Insurance, according to a report by Mint.

The deal will involve a cash-and-stock transaction, along with some early renewal investors that potentially sell a portion of their stakes. The combined animal is expected to secure additional money leading to a potential first public (IPO) offered.

Farhan Akhtar Finds ‘sukoon’ With Loved Ones

The deal can also be the Astreamline IPO path for Cardekho, which targets a public list next year in the fiscal. Currently, Kardeyekho co-founder and Amit Jain CEO, is holding a 70% stake in insurancedekho. According to the resources, the group aims to unload more than a 20% stake in the gurugram -based company before the Red Scrap Prospectus (DRHP) is deposited.

The combined animal aims to offer a wider product range, improved customer experience, and boosts operational efficiency. The development is coming soon after the Insurancedekho received the short insurance compound license from regulatory insurance and development authorities in India (Irdai).

The company also raised $ 60 million in a series of B financing led by Mitsubishi UFJ Financial Group in October last year.

While the Insurancedekho has not yet reported FY24 results, the firm posted Rs 96.5 revenue crore on FY23 compared to Rs 47.9 crore on FY22. It also reduced loss by 28.6% to Rs 51.6 crore during FY23.

Excited To Launch Heph, Our Latest Insurtech Innovation! With The Insurance Market At $132b, Insurancedekho Remains The #1b2b2c Platform. Heph Streamlines Insurance Distribution With Cutting-edge Saas Solutions For Distributors, Customers, And Partners

Renewbuy, on the other hand, rose $ 40 million in continued financing in the D series in July last year. The nine -year -old company did not release its financial for FY23 and FY24, reported Rs 190.8 crore with revenue and a crore loss of Rs 98.9 on FY22.

Bareback media recently raised funding from a group of investors. Some investors may be directly or indirectly involved in a competition business or may be attributed to other companies we can write. However, it does not influence our report or scope in any way. You can find a list of our investors here. This innovative platform is designed to improve the efficiency of the insurance distribution across