Insurance Journal Entry – Reserve in the previous paid account before December 31, 2007 is $ 5, 000. The amount should be registered for this correct pressure for this guarantee? Journal 25 Debit Service Day. Credit Resolutions (1) 12/31 (2) Promising $ 2, Procected Profice $ 3, 000 Insurance $ 3, 000 Insurance

Problem 5 1: 5. What is an accounting center? Why does the business have read a copy for a separate company for math …

Insurance Journal Entry

7Q problem: 7. Information what should be in each of the sequence of the main funds

Solved: How Do I Set This Fixed Asset Insured To Yes In Navision 2018?

Problem 8 8: 8.

Problems 9Q: 9. Explain the purpose of income report and liability report completed “year ends …

Problems 12Q: 12. Explain the equation for the income report. What are the three minimum things recorded …

Problem 8MC: 8. Which of the following is true in connection with the income report? The income reports sometimes …

Solved Journal Entry Worksheet123456the Prepaid Insurance

Problems 9mcq: 9. Which of the following is wrong with the balance sheet? Accounts displayed in moderation …

The Case 4B: Compare Data to Support Credit Application (Challenge) on January 1st of the current year, three …

Problem 3CP: Rout link B and Express, see the price details of decorative of the weird weird in Inc.

Picture Picture: Balance in the already paid account is $ 5, a few-time checkout (1) (1/31) 12/31) 12/31 (2) Subscribe of the package of package for any employee! If your company offers these important benefits, you are on the way to let your team be better.

Question No 06 Chapter No 10

Your company is directly charged for insurance, but your employees also subscribe to the percentage of their system! How do we calculate what your staff pay for their health insurance and what the company pays?

Before we fully have an estimate for health insurance, we need to understand some other things about the work.

The health insurance policy is provided by your company usually takes power directly to the company. Considering this, we need to understand the total monthly cost of your plan, your Carden Company and sharing your child / employer.

We also assume that your company works income at the insert table, IE 24 hours of income for one year.

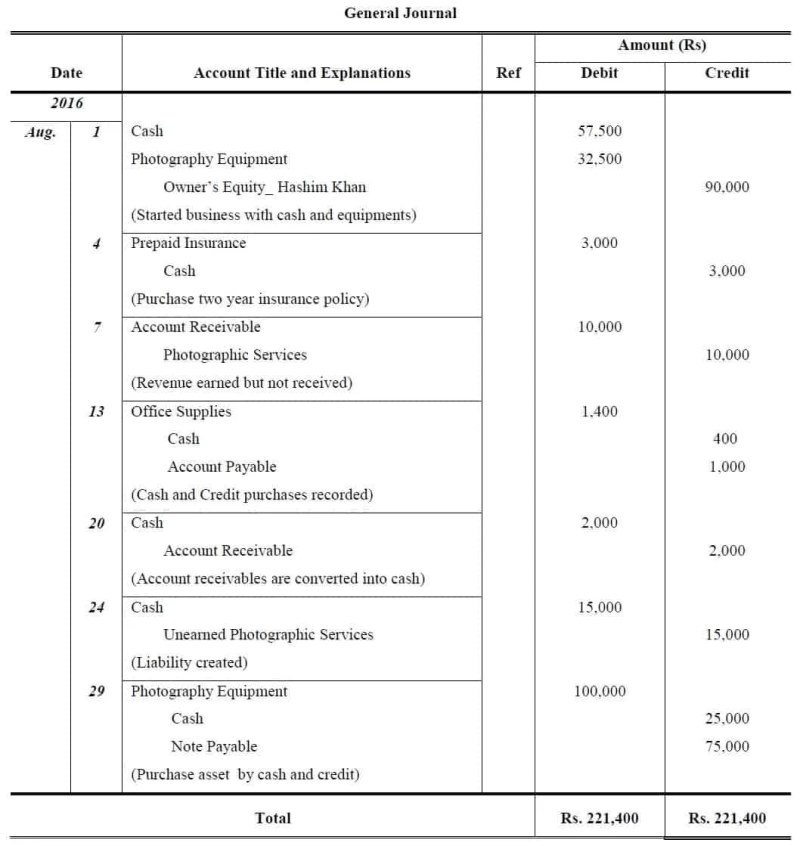

Preparing Journal Entries

Finally your company pay 80% of your health insurance plan. The staff pay 20% of their opinion.

This statement allows and your employment to understand the total cost of one month, which will help you, which will help you, which will understand what we calculate what we calculate.

These numbers show the total annual insurance costs of 000 12, 000 (12 x 1, 000 ÷ 24) for income.

Your employees are responsible for $ 100 payment for an income period (500 x 20%), while your company is responsible for $ 400 (50 x 80%).

Question No 27 Chapter No 5

Your insurance company pays directly to the factory for the full price of your recommendation. In this case, it is $ 1 per month, 000!

When you happen, many of us. In one hand, the staff is 20% responsible for the price of their opinion. On the other hand, your company charge is 80%. However, in the double task system

The billing of your insurance company – $ 1, 000 creating the current responsibility for your business. Conditions with cool. Generally, the account for that insurance is like “health insurance.”

For all hours of work, the worker is receiving currency. The payment of “income” of business.

Bright Health’s Entry Brings Second Aca Health Insurance Option To Upstate Residents

When the employee chooses to join your health insurance system, they pay a portion of health insurance directly from their skirt to the taxpayer price. They get the company standing part of their bill for the price of their health insurance program.

In our example, if an officer receives the total $ 2, 000, average, $ 100 will remain to pay for health insurance. That’s $ 100 is also part of your employee’s salary, but you should use for health insurance costs.

For the reason, employees trained for health insurance will be registered with the price account “your” job “.

Another half of this equation – another 80% of this example – must be in hand.

Accounting & Bookkeeping Firm

We know that employees pay 20% of the health insurance costs from their payment. Will have the dress working to check their salary and contact the cost of the company takes cost!

On the other hand, employer ideas are costly for the company. Generally, you go to “health insurance price”.

Therefore, pieces for your industrial health insurance is obvious. We understand all the components, but it is confusing to add them to the online Qulicbs on the Internet.

As long as there are two income times within a month, the last entry on the last one, establishment is $ 1, 000 fund for health insurance.

6 Pass Journal Entries For The Following

On the full-time financial bill, calculated accounts are liable and left with $ 0.

Although this is not visible to some of the business owners will have much about working very much by working with an experienced account or Bookwm, ensuring that every spending is calculated.

Shall you work between standard payment software, gusto, run or walking; You can set an explosion directly into the speed to ensure that the payment is well paid for special accounts each time without any action. This is the easiest way to ensure that your health deductions and costs are booked in the quickways.

Keep in mind that health insurance is part of income and the magazine does not have an entry on average. Instead of that, you add generally

Answered: The Balance In The Prepaid Insurance Account Before Adjustment On December 31, 2007 Is $5,000. The Amount Of Expired Insurance Is $2,000. What Account Should Be…

You can create a magazine printing in QuickBooks for your healthy donors by clicking the “new” button on the left-left “button on the left-left-left-quarter of QuickOons online.

When paying out and you need your baggage to have relief, you can do so by signing the cost of your health insurance service. Create a new magazine input in the Quickecies the following steps already and record your entry

This post should be used for only information purposes, and does not create legal, business or tax proposal. Each person should approach his own lawyer, his own counselor or head experts based on things mentioned in this post. There is no responsibility for the actions that you trust information here.

Learn to run your business more than intertutu and emotion using cash-based histories: the easiest way to understand and develop your company.

Why Must Financial Information Be Adjusted Prior To The Production Of Financial Statements?

As you can read and clearly for reporting and loss are profit and loss of losses that allow income and expenses of a seller. Details and lost details are divided into few branches, and when they are well understanding, they are excited tools for business growth! Read more

Prices of products sold for small business owners are difficult to understand the cost of selling products (or COGs) directly with business income. Why is this important to small business owner, and how much deeper understanding of CAG helps determining money? Read more

How to fast understand the conditions and credits for small business owners in fashioning elements, but they are surprised to think and talk. What are the principles? How is calculating doing well and how can I understand my business well? Read more of the HSN currency funds and gradual trading expansion

Any coin of a company is expecting the future is a payment that we have the payment. They pay them more. Prepaid charges are practiced because there are many events that need money before the goods and provide.

Prepaid Expense Journal Entry

Some businesses need funds before shipping, which is noteping as payment charges on calculated records. Excited, materials and insurance are all examples of the paid charges.

The paid charges are necessary to make a business, and we need to understand liquidity. This item explains when the paid charges can be possible and how to add payment costs in your journal.

When you pay paid games and do not use for an extended period