Nvidia Stock Price November 2021 – Technical Giant NVIDIA (NVDA) has long been one of the people who love the repertoire of growing stocks. With a growth of more than 600% in the past five years and the market share of more than 450 billion dollars, computer graphics experts are a scene certified by the industry. So why, with the nearby web 3.0, does NVDA’s stock price began from 2022?

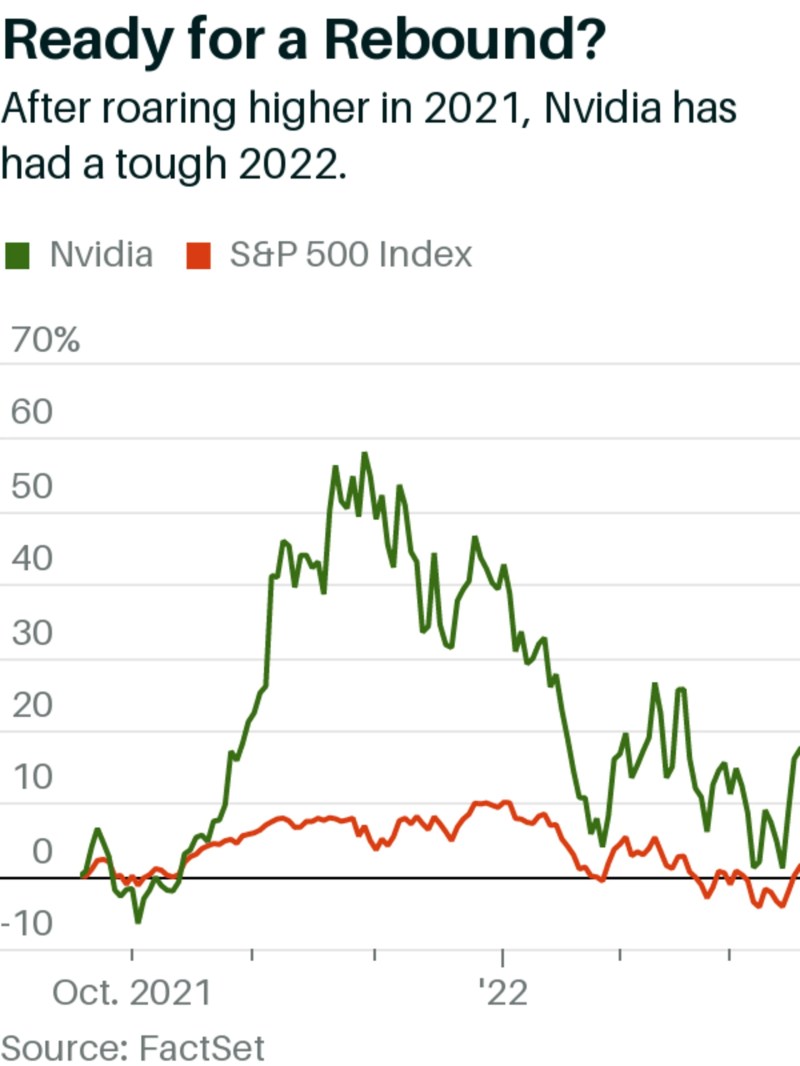

Facing a highlight in November 2021 witnessed NVIDIA’s stock price of $ 330, Wall Street has tolerated a recession due to inflation that has a special influence on technology shares. Today, NVIDIA has been sitting more than 43% at all times despite being one of the strongest technology stocks in the past decade.

Nvidia Stock Price November 2021

In recent years, NVIDIA has been supported by some profitable winds, from data centers and gaming to cars, AI and cryptocurrencies. With important businesses that adjust their models to combine the appearance of Metavern and Web 3.0, NVIDIA seems to become a major player in the next major evolution stage on the World Wide Web before the stock is pulled.

Nvidia Corporation (nvda) Stock Analysis And Forecast For 2025

As we can see from NVIDIA’s price movements, stocks are still sitting beautifully, although starting in 2022, but it is important to realize that the value is wiped out by the company’s market share is unique. Moreover, Bain’s analyst Tristan Gerra believes that short -term pain can wait more.

“We believe that recent orders have begun in consumer GPUs, controlled by excess consumer consumer warehouse, especially in Western Europe and Asia, reducing consumer demand (reflected by continuous short discounts), especially in China, in China, for short -term factors.

Due to the embargo in Russia, and the country’s gaming and cryptocurrency mining, the greater demand for GPUs is probably on the road. In addition, the demand for GPUs from China’s consumer market, accounting for 25% to 30% of the entire GPU market of the world, has weakened “significant weakening on the road.”

Although the larger market pressure tied NVIDIA’s stock to decline after many years of parabolic growth, there was little doubt that the company had an interesting future in the future.

Stock Market Stock Forecast Nvidia Stock History New Releases

For example, the company’s graphics card from Se -RTX 2030 has worked well in the market, while the NVIDIA axis shortage is a central part of the supply chain in data processing due to the past two years. In fact, the demand is thought to have grown to the point where NVIDIA may struggle to comply with the needs even without chip.

NVIDIA is expected to announce the RTX 40 GPU -in the fall in 2022, set to pave the way for a new station to upgrade the hardware between users.

The important thing is that a series of NVIDIA services are designed to prepare for the company for the Metavern era capable of ensuring that it has a prosperous future and returns to form on Wall Street. At the Company’s 2022 Graphic Technology Conference, a series of chip jumping products for AI Super Computers, Grace GPU for data center, Drive Hyperion 9 driving platform and expanded NVIDIA OMNIVERSE FOR METAVERN market, published. The role of NVIDIA in the development of Metaverse cannot be underestimated.

Maxim Manturov, Head of Liberal Finance Department, stated that the development of transmission vessels was planned to be extraordinary in the decade – with NVDA emphasized as an important stock for monitoring.

Is Nvidia Stock A Good Long-term Investment? (nasdaq:nvda)

“Metaverses will affect most industries on the planet. Whatever you do to make a living, this technology will find applications in your field in the future,” Manturov explained. “Businesses have many ways to use space technology, from being stored

Manturov added, “Emergle’s research analyst predicted that the Metavern market would increase to $ 829 billion by 2028 and the intelligence analysts Bloomberg predicted that it would reach $ 800 billion by 2024. Morgan Stanley estimated China’s Metaese market market

Such astronomical figures go on the way to illustrate the level of the market where NVIDIA can achieve in the coming years.

Although Nvidia’s short -term prospects have been cloudy by a number of factors to minimize around large -scale technological deposits, record inflation, deficiency of bricks and geopolitical tensions appear from Russia, it can still be optimistic to be optimistic. NVIDIA products. If the company develops to provide GPU -To make the future repetitions of super reality, the price of NVDA today can be considered extremely cheap.

How Nvidia Dethroned Tesla To Become Wall Street’s Most Traded Stock

The view and opinion expressed here are the views and opinions of the author and does not necessarily reflect them, Inc.

Now or see the quotes mean something to you, anywhere. Start surfing stocks, funds, ETF funds and more assets.

Now or see the quotes mean something to you, anywhere. Start scrolling through stocks, indicators, ETP and more assets.

Create your monitoring list to save your favorite quotes. Login or create a free account to start.

Nvidia (nvda) Stock Faces Disaster Ahead, According To Historical Analysis

Now you will be able to see the real price and actual activity for your icons at my quote.

The category of smart investment is supported by our partner Tipanks. By connecting my portfolio to the Tipranks smart investor portfolio, I accept their uses.

By clicking on “Accept all the cookies”, you agree to store cookies on your device to improve the navigation on the website, analyze the use of websites and help with our marketing efforts. Cookie Policynvidia Corporation (NVDA) has completed the journey for many years from special chip designers to large technology power by 2020, adding a significant market share in reaction with free wounds of Intel Corporation (Intc). The market value increased to $ 318 billion in the year, making it the eighth of the NASDAQ 100. Better, the company’s growth will continue by 2021 and increase the odds in one year of excellent activities.

The stock has achieved more than 120% in the first eight months of 2020 and reduced in a adjustment, and worked on extremely technical readings. The leading athletes of a year often work less in the following year, but Intel’s accidents have opened up opportunities for many years of hardship. The only disappointment of 2020 is the failure of sharing stocks, but NVIDIA can see light by 2021 and take advantage of favorable market conditions.

1 Stock To Buy, 1 Stock To Dump This Week: Nvidia, Meta Platforms

However, the price action did not see the breakthrough compared to the highlight of September nearly $ 600 when we lean the calendar in the new year. The fluctuations and purchases of mutations have not existed in the past two months, replaced by a narrow range with no signs of waking up from the dead. Pressure -pressure profit can easily control this dull action and activate the withdrawal until September -Lavt is $ 468.

Wall Street’s consensus on sharing NVIDIA has organized a “strong purchase” evaluation throughout the year, currently based on recommendations 19 “buy” and 3 “hold”. An analyst recommends that shareholders close closed positions and move to the sidelines. The existing price goals ranged from a low $ 400 to a high level of $ 700, while stocks were set to open on Wednesday to increase $ 80 according to the average target of $ 600. This modest position will support the upside down in the first quarter.

Fluctuations are a statistical measure to return profits for a certain security or market index. In most cases, the higher the fluctuation, the safety is risk. The fluctuations are usually measured by deviation from the same security or market index.

A strong trend at the top at $ 292.76 in October 2018, creating a road for rapid decline, throwing nearly 170 points at a low level of 52 weeks in December. The next wave of recovery finally completed a return trip to the previous highlight in February 2020, offering a quick demonstration, then a failed outbreak and down 135 points. Bulls took control in the second quarter and drove a V -shaped shape that completed 100% of the first quarter stop in May.

Nasdaq 100: Nvidia Share Price And Q1 Earnings Results Preview

The stock broke out immediately and entered an advance at the speed of almost doubling the stock price to the prominent level of September of $ 589.07. It dropped to $ 468.19 just two sessions later, completing the edges of a transaction area that has not been broken in the past four months. A November outbreak has decreased, bringing a triangular model that is likely to increase the need for a third bought girl to complete.

However, the weekly and monthly sales cycle is still being controlled, which increases the odds of decreased tests in September for support. A bounce at that level can create a rectangular pattern with “reduced edge” because stocks must break 50 days