Renters Insurance Quote Meaning – Now, rentals and owners were only responsible for all these situations.

In this article, we will discuss what is protected by insurance, as well as other information such as its cost and if it is the need for rent properties.

Renters Insurance Quote Meaning

Rental insurance is the type of insurance that includes a wide range of unexpected events, also known for the risks covered.

Why Renter’s Insurance Is Important

This type of insurance includes events between the coverage of personal goods, coverage of responsibility and additional subsistence costs. The rental insurance coverage is very wide and there may be in many situations.

However, it is very important to know what your lenses look like like insurance coatings. In the next section, we will overcome some of the main things that insurance covers.

Keep in mind that the fonts you offer the coverage can be changed from this list, so contact your fonts with the insurance provider to make sure you are clear.

This, such as electronic devices, furniture, kitchen utensils, jewelry, vehicles and more, are damaged or destroyed.

A Guide To Tenant Insurance In Canada: Do You Actually Need It?

In the case of an injury that a guest visits the goods, your tenants would be responsible. Hercured insurance generally undergoes a kind of injury caused by a guest on the property.

In addition, if the tenants are stolen or the goods are damaged, following theft, the insurance of the tenants generally covers damage.

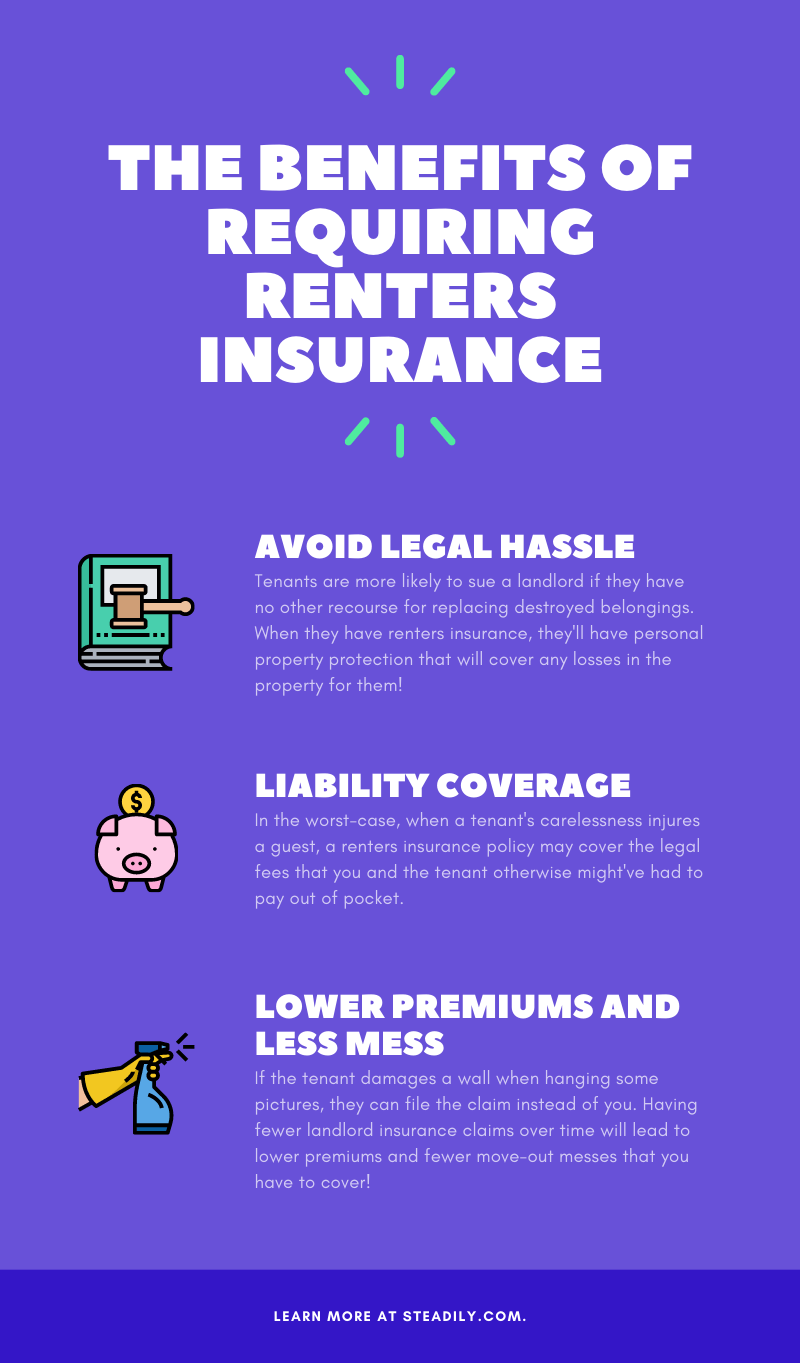

So far, we have talked a lot about the advantage of tenants. But who are the owners of the owners?

Easy to easily, rental insurance protects you from disputes if your tenant is damaged in your property:

The Price Of Peace Of Mind: States With The Most Expensive Renters Insurance

And you think that your liability insurance will be covered in this type of event, even if the tenant is injured even for his actions.

Similar to a trial, the tenant may request whether the goods can be accused of payment of damage if they have no way of covering.

What your tenant seems to you, it is better to play how he will play after a disaster and instead of the rental policy that you must cover even more.

If your tenants have no rental insurance to tell you that you can contact legal action or damage, which can cause other problems.

The Benefits Of Renters Insurance In Houston

Workers’ insurance here can cover material damage that may contain pets and assume responsibilities in the event of dog bites.

However, make sure you check your insurance company, which the owners’ insurance policy offers, some because they offer petty pet coverings.

After reading all these advantages, you might think that you may be compulsory for tenants rental insurance for tenants.

Some states, such as California, allow authorizations to request rental insurance. However, if you want to know more about your specific condition, it is preferable to check the laws of state loans.

Video Camera Equipment Insurance: Why You Need It

We therefore know the many advantages of rent insurance, we get to know the most important part – how much it costs.

The best part of this is the cost of the quantity of proprietary insurance. For any coverage that appears here, the tenant should spend about $ 179 or $ 15 per year in tenants’ insurance.

Some insurance companies may also offer rental insurance discounts to help reduce the cost of premiums and obtain income in the insurance budget.

In addition, a combination of the advantages that can take advantage of your tenants and your low prices.

Renters Insurance In Boynton Beach And Stuart, Florida

Consequently, you will cover your responsibility policy or many ways covering your property.

Santiago is a diploma in Aday and has software development training. As a marketing specialist, Santi likes to simplify the complex aspects of goods management. Insurance insurance offers protection of your estimated goods and the protection of responsibilities. Learn to choose the right coverage, the factors that cause essential costs and reflections for a non -worry rental experience.

These assessors are industry leaders and professional writers, regularly those who help celebrity publications like Wall Street Journal and the New York Times.

The criticisms of our experts examine our articles and recommend changes to ensure that we protect our high levels for precision and professionalism.

Best Renters Insurance In Rhode Island: Top 5 Companies

Our expert examiners have advanced diplomas and certificates and have years of experience in personal finance, retirement planning and investment.

Finding the best rental insurance is most of the rentals, but they don’t have to spend a lot of time weighing all the different options.

But if you rent the house, you live in the house, the house or an apartment, the owner insurance is not so important for the owner as the insurance of the owner.

Wiskers often assume that if they undergo losses due to a disaster, such as fire and theft will be covered by the insurance of landowners. It is not true!

Td Renter’s Insurance

The owner’s goods insurance will cover the destruction of the building, but not the content within it. And in terms of almost all the content of a rental property, you will be without luck if a disaster is considered.

It would be impossible to say which company offers the smallest insurance insurance premiums. This is the quotation that you will get will be different according to your personal needs and your profile, an insurance policy that you can create with the type of owner, the geographic location and the type of goods you are experiencing.

Insurance for rental insurance for companies participating in the same market are the rentals. It means that it pays for purchases!

And although some companies offer additional coverage, it is difficult to know what they were given or gave more specific quotes. It is likely that similar similar coatings will be available with the five companies.

How To Compare Renters Insurance For The Best Prices

Revenue insurance is a specific type of coating that guarantees goods saved in your rent. More specifically, the covered income depends on the type of insurance.

Whether you want to protect your jewelry, a new laptop, high -screen TV or many other items next to your heart, good income insurance is available.

Not only when replacing stolen goods or damaged by rental insurance, protects your property and the supply of a protective plan if your home is damaged. Let’s see those below.

Similar to the owners’ police, rental insurance covers the content of the house you rent. It includes furniture, electronic equipment, clothing, household appliances and personal effects. As a rule, you will take a policy that will take $ 10 and $ 100 and $ 100 from anywhere in personal property, even if it was higher.

Little Known Things Renters Insurance Covers

To determine the amount of personal goods you need to determine, you need to make an inventory of everything you have. Enumerate the inventory, then get the cost of retail prices. It’s strict, but it’s the only way to know about the cover you will need.

It is generally the best to take photos, especially precious items. This will facilitate the task if you need to claim the insurance company.

Personal liability coverings will protect you when an accident or injury will arrive at someone else at your home. This can slide and fall into the house, bitten by a family animal or other types of injury.

Visitors could also resolve people, or even owners, if the cause of injuries is determined in your fault.

Best Renters Insurance Of 2025

Covering personal responsibilities will protect you from your assets and assets for the aspects attached to you.

For example, if destruction of goods is destroyed or damaged, the insurance policy will pay the fair resettlement costs, such as the hotel stay, meals and other expenses related to temporary accommodation situations.

With certain insurance companies, it can be offered as part of a standard set, but with other additional provisions:

It is a goods cover beyond the property itself. For example, there may be goods deposited in the common areas of the basement of your apartment which depends on damage, destruction or theft.

Best Renters Insurance In 2025 (your Guide To The Top 10 Companies)

It can also be distributed to personal objects stolen from your vehicle, generally covered by the rental policy. It can be a laptop when it is specifically covered by the policy of your lens.

Rental insurance can also be lost by an airline to cover lost luggage.

You should never cover all property insurance to cover all goods. Some have specific exclusions, and others will exclude an element if it is not specifically listed.

Specific common coatings are domestic computers, jewelry and skins, personal businesses